A series of individual reviews for each active MRP theme, specifically addressing the effects of COVID-19 on each of MRP’s current and recently suspended themes, as well as the broader macroeconomic outlook.

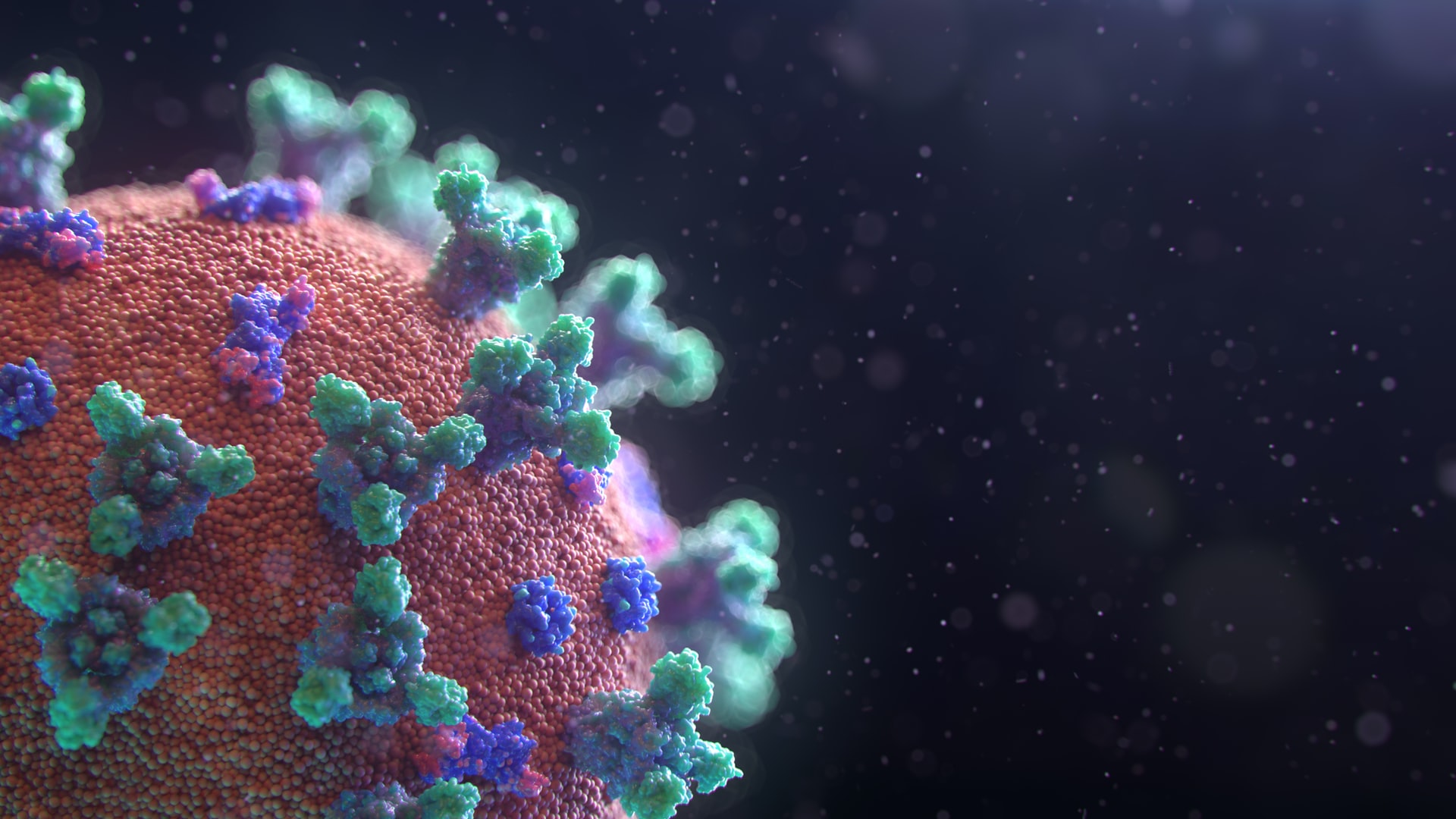

COVID-19 has undoubtedly been the most dramatic black swan event since 9/11. The initial spread of the virus in China prompted concerns about global manufacturing, supply chains, and growth, but the infection of Western nations has proven even more consequential for global markets.

At the time of this publishing, the total diagnosed cases number nearly 800,000, with about 590,000 of them being active cases. Virtually all nonessential businesses have shut their doors across much of the US and a large number of other countries. Mass layoffs have begun.

22 States have issued stay at home orders, as “social distancing” has become the term of the month. According to Business Insider, the state and city populations affected by some kind of stay-at-home order add up to approximately 160 million people – nearly 49% of the US population – and counting.

As a result, the economic and financial landscape of many key markets has seen dramatic shifts since the beginning of March. In the US, interest rates have plummeted, unemployment is surging, and second quarter GDP growth is all but certain to crater below 0%, perhaps diving all the way to a double digit decline. US initial jobless claims have skyrocketed to a record 3.28 million in the week ended March 21, up from just 211,000 two weeks ago.

In February, FactSet data indicated that YoY earnings growth for the S&P 500 turned positive again in Q4 2019, ending an earnings recession that had lasted three consecutive quarters. However, uncertainty has now enveloped most earnings projections…

To read the rest of this Viewpoint, START A FREE TRIAL You’ll also gain access to: If you already have a subscription, sign in