The end of the year is finally upon us! This month’s Viewpoint offers a quick look at the state of the markets heading into 2021, followed by an overview of our active and recently suspended MRP themes.

Expectations of a further advance in stock prices through 2021 are widespread. Recent surveys show Wall Street strategists projecting a 9% gain in the year ahead. Most are basing their case on the assumption of zero interest rates and a strong jump in corporate profits.

Per Bank of America’s Fund Manager Survey, a decade-high 70% of money managers, overseeing $534 billion, believe the global economy is in an early-cycle phase. In total, these managers are also underweight cash as the survey, conducted between December4th – December 10th, marks the first time cash levels have dropped below 4% since May 2013.

Though this indicates investors are the most bullish they’ve been on stocks and commodities since February 2011, BofA warns it may also be a signal of overexuberance in an overbought market.

The vigorous rebound from a lockdown-depressed first quarter should lead significant earnings growth in the second half of the year. It is hard to argue with that logic; and we agree with that portion of the consensus view. As of now, however, very few seem to be concerned that massive fiscal and monetary stimulation may lead to an acceleration in inflation which, in turn, could push up longer-term interest rates – even as the Fed keeps short-term rates flat.

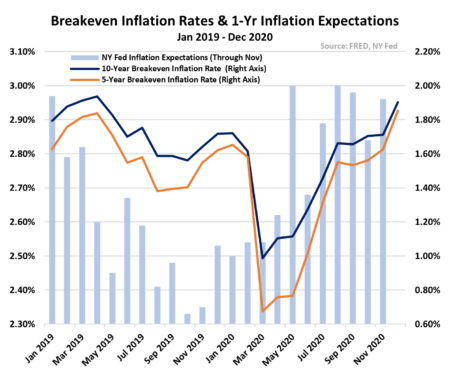

Over in the fixed income market, expectations about future inflation have been creeping up and are now higher than pre-COVID levels. Just before Christmas the 10-year breakeven rate, derived from prices of US inflation-protected US Treasuries (TIPS), hit 1.97%, the highest point since April 2019.

Most of MRP’s Themes are driven by sector-specific forces. Nonetheless, in the extraordinary environment of the year 2020, they have exhibited plenty of beta while being boosted by the soaring overall market.

Despite this, few hurdles are evident in the short-term. Professional investors would be well-served to focus on themes. It is the identification of change-driven themes that is our mission at MRP. So, in the face of a rapid change and uncertainty in markets, a review is in order. Currently, we have a total of 18 active themes.

What follows below:

- A tabular, year-end review of MRP’s current list of open themes, displaying returns of the underlying funds we utilize to track their performance

- Detailed breakdowns of each individual theme

- An overhead view of the themes we closed throughout the past year…

To read the rest of this Viewpoint, START A FREE TRIAL You’ll also gain access to: If you already have a subscription, sign in