Despite a combination of ultra-easy monetary policy and trillions of Dollars’ worth of QE flooding the economy throughout 2020, signs of breakout CPI data are scant thus far. Some have been quick to proclaim the death of strong and sustained inflation, but we posit that a pandemic-induced plunge in the velocity of money may have created a delayed reaction in price pressures. If so, inflation could be set to snap back once COVID-19 restrictions ease – perhaps rising even higher on the back of more fiscal stimulus, elevated commodity prices, and new legislation set to raise the US federal minimum wage.

Stock prices have continued to hover fractionally below all-time highs with widespread expectation of further gains ahead. Most bulls seem to be counting on big gains in earnings figures through this year and next.

Though rate hikes or tightening from the Federal Reserve seems unlikely at any point in the near future, the assumption that rates will not rise much could prove to be the Achilles heel of this amazing bull market if an upside surprise in inflation data changes the Fed’s calculus. Rates currently remain far below historic norms at almost zero and, following an easing of COVID’s stranglehold on the global economy, the massive surge of liquidity that’s been pumped out by central banks is likely to show up in higher inflation. This, in turn, would push up long-term rates even while short rates remain low for now.

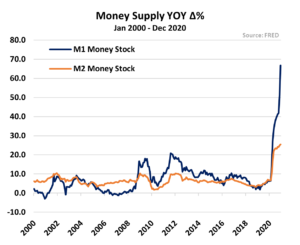

No one can argue that there has not been an unprecedented explosion in the supply of money, a trend MRP has been sounding the alarm on for months. In the US, the Fed’s balance sheet has almost doubled in just the past year. That surge has led to a related explosion in the M1 and M2 monetary aggregates.

History shows us that that runaway money printing causes a rise in inflation. But with pandemic-induced restrictions and lockdowns depressing demand, inflation has remained subdued. Various measures of contemporaneous price pressures show little if any upward momentum in the US. In December the consumer price index (CPI) showed a gain of only 1.3% YoY. It is worth noting, however, when you strip out food and energy prices (also known as the Core CPI) prices growth is slightly stronger, having risen 1.6% versus the same time last year. Still, weak Inflation data remains prevalent around the world.

As is almost always the case, there is no shortage of new theories and arguments why this time will be different and this state of disinflation will be apart of “the new normal”. Take, for example, modern monetary theory – also known as MMT.

Last August, MRP did a deep dive into MMT, which aims to explain the basic dynamics of our present-day “fiat-money” economy through public sector spending and taxation – based primarily on the assumption that the government does not operate on a “household budget”.

Essentially, the deficit is not so much of a concern since taxes serve as collateral for government spending and not as income.

It is important to stress that MMT is not a belief that resources are infinite or that inflation doesn’t exist. Rather, proponents argue, limits of government resources are not simply defined by the size of deficits. Most MMT aficionados argue the size of deficits do indeed matter, but are secondary to inflation and unemployment, in that order. In the simplest terms, MMT proposes measuring stimulus and deficit financing not by how much it costs, but by how effective it is.

Since the US has yet to see any meaningful breakout in inflation data, despite printing several trillion Dollars in the span of about 9 months, MMTers have been taking victory laps and enjoying the media spotlight. To be sure, policymakers’ suspension of almost any prudence in regard to deficits or balance sheet expansion over the last year has made it very fair to say that we are living through the most significant MMT case study of all time.

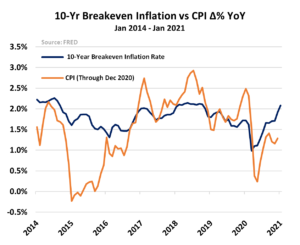

But it is still possible, if not likely, that a delayed impact is brewing. For example, inflation expectations are indeed on the rise. In the bond market, the so-called breakeven rate of inflation – the difference between the yield-to-maturity of a conventional Treasury coupon bond and that of a Treasury Inflation-Protected Security (TIPS) bond of the same maturity term – has been on the rise.

The 10-year Treasury breakeven, equivalent to inflation expectations for the five years beginning five years from now, has climbed to over 2%, quadruple its level last March. Meanwhile, the latest survey of expected changes in inflation, conducted by the University of Michigan, showed inflation expectations jumping from 2.5% in November to 3.0% for December.

Meanwhile, commodity prices have been breaking out to new highs in recent weeks, possibly preceding higher prices for final goods coming down the pipeline.

Lumber prices hit an all-time record on Thursday, closing out just shy of $900 per 1,000 board feet. Though copper slipped a bit from an 8-year high it touched earlier this month, closing out yesterday at $3.56, that is still 37% higher than this time last year. Each of those commodities are currently active on MRP’s list of themes.

Iron ore is close to a 9 and a half year high at $168 per tonne and oil has surged 46% to more than $52 per barrel since the end of October.

New legislation that’s set to raise the federal minimum wage in the US may also present price pressure we haven’t seen in some time…

To read the rest of this Viewpoint, START A FREE TRIAL You’ll also gain access to: If you already have a subscription, sign in