2021 marked another successful year for MRP’s themes, as 16 of 21 themes we closed throughout the year outperformed the S&P 500 over their lifespan. This month’s Viewpoint offers a quick look back at those themes, as well as the state of the markets heading into the new year.

Though 2021 was another strong year for nearly all asset classes, markets wrapped things up on a sour note. Investors could continue to face challenges in the year ahead amidst a host of uncertainties. The laundry list is a long one: geopolitical tensions, rising signs of unrest across former Soviet satellite states, continued Omicron-related disruptions, persistently high Inflation, and a bull market that is getting long in the tooth.

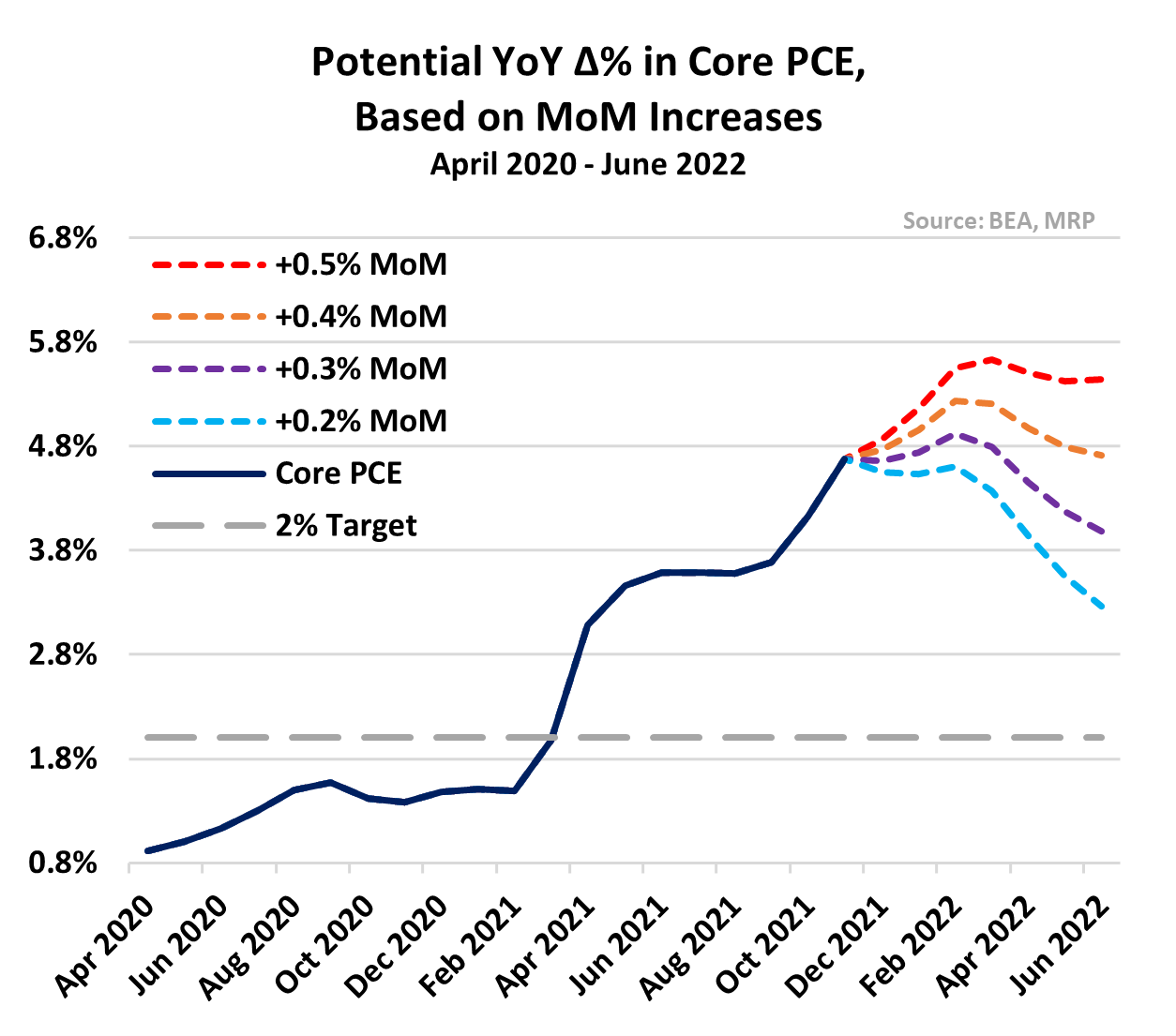

As if all of that isn’t enough, the Federal Reserve has begun initiating a sudden shift from accommodative to tighter monetary policy. The latter became evident when Fed Chair Jerome Powell retired the term “transitory” in regard to inflation, acknowledging that YoY growth in the consumer price index (CPI) has surged to more than triple the Fed’s stated 2% target rate and will last much longer than they had expected. In December’s FOMC projection materials, median expectations for the Fed Funds rate among policymakers indicated an expectation for up to three hikes in 2022 (assuming the standard 25bps pace) and three more in 2023. Some observers, ourselves included, suspect the Fed could begin projecting an even more aggressive tightening if the CPI surpasses 7% into the new year. According to the Fed’s preferred gauge of inflation, the core personal consumption expenditures (PCE) index, we continue to project inflation to peak by the end of Q1, but to remain elevated throughout the course of the first half of 2022.

Because of that, the Fed’s plan to raise nominal rates is unlikely to drag inflation-adjusted “real rates” out of deep negative territory. In this radically changed environment, investors must expect more volatility, alongside pressure on particularly extended P/E multiples. Over the last five weeks, the 10-year yield risen as much as 45bps from its December low, pushing beyond the 1.8% threshold for the first time in two years. In equity markets, long duration assets are already underperforming and numerous growth stocks are experiencing declines of more than 20%. For the first time in several years, the emphasis appears to be shifting to value over growth.

What follows is a detailed review of MRP’s “Active Themes” in 2021, including those closed throughout the year and our current list of Active Themes.

First, we present a list of the themes we suspended throughout 2021.

MRP’s Themes are based on identifying thematic, disruptive changes that ripple through entire industries, technologies, and business models. The Daily Intelligence Briefing (DIBS) reports we share with our clients reflect MRP’s workflow in that process. We use a variety of ETFs, ETNs, and similar securities to represent the performance of our Themes. Assets utilized to track the Themes that we closed throughout the last year returned an average of 61%. That compares to an average S&P 500 gain of 30% over each Theme’s lifespan…

To read the complete Viewpoint, current MRP Pro and All-Access clients, SIGN IN MRP Pro clients receive access to MRP’s list of active themes, Joe Mac’s Market Viewpoint, and all items included as part of the MRP Basic membership. For a free trial of our services, or to save 50% on your first year by signing up now, CLICK HERE