MRP’s research process reflects founder Joe McAlinden’s 50 years of experience on Wall Street. The methodologies he developed as chief investment officer of Morgan Stanley Investment Management, where he oversaw more than $400 billion in assets, provide the foundation for the strategy research MRP now brings to hedge funds, pension funds, sovereign wealth funds and other asset managers around the globe.

Joe is joined by an experienced team of Wall Street professionals from diverse backgrounds to provide MRP’s clients with valuable insight outside of the mainstream.

Our Process

Identifying disruptive change that leads to new investment opportunities.

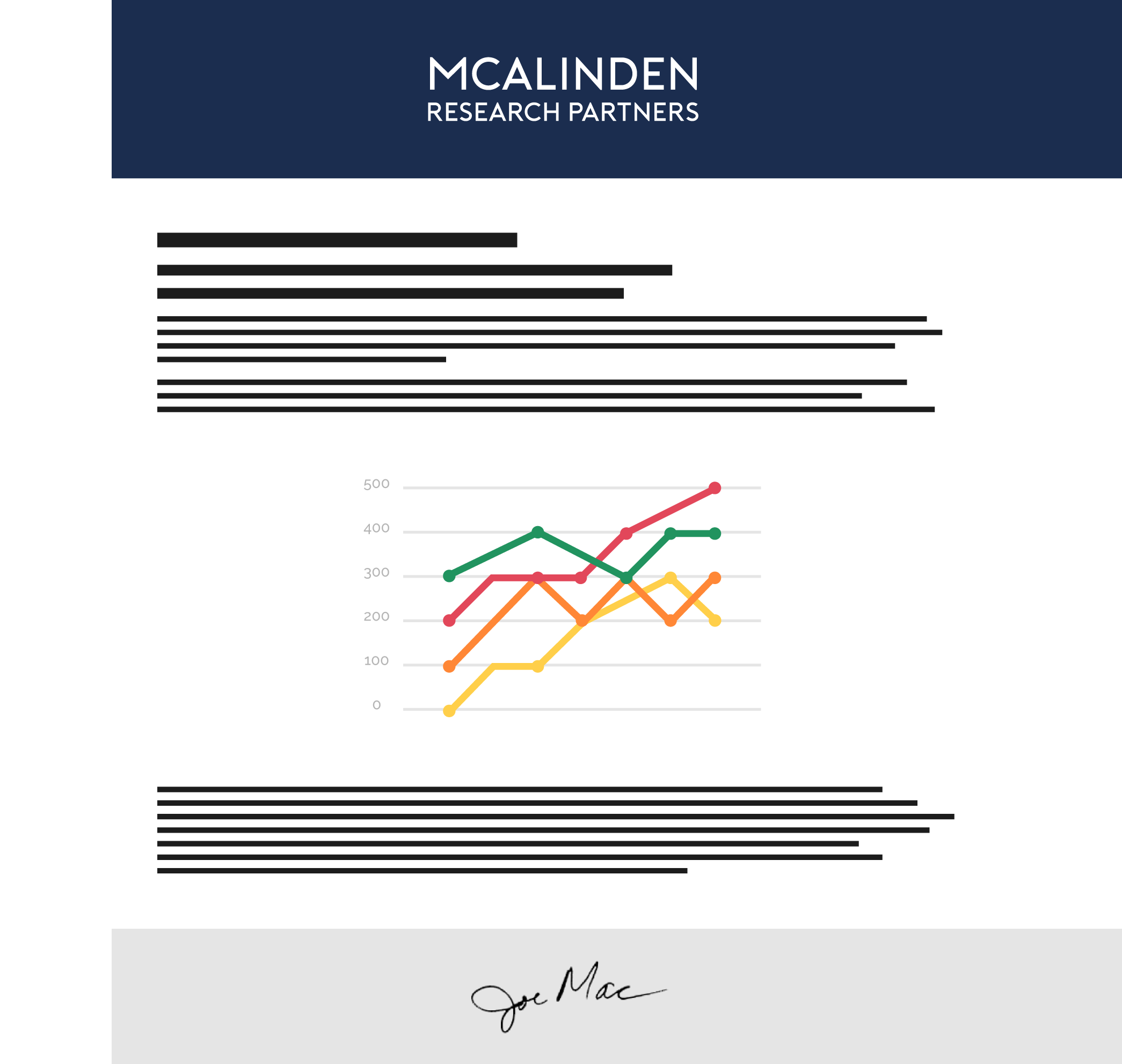

MRP offers a suite of products across several different subscription tiers. Our entire focus is on identifying change that will shift the equilibrium and create an investment opportunity. To do so, we take an inductive approach, which means keeping an open mind and letting the data, news and events unfolding speak to the shifts occurring across the globe.

Each day, our clients will receive our Daily Intelligence Briefing (“DIBs”) and Macrodeck of news and data that rises to the top of what we believe is relevant to signaling change. When we are struck with a new thematic idea, we will map it out for you in the DIBs or in Joe Mac’s Market Viewpoint report. Those ideas go on to become what we call “Active Themes” – areas of specific interest that we use as a focus point for our research efforts.

You should look to us for the over-arching idea. We do not spend time on earnings models, as so many others already do so. Accordingly, we do not recommend individual securities. We believe that a significant component of alpha comes from getting the big picture right — such as sector, industry, and theme — and that’s what we aim to do.

The catalysts for our ideas come from any number of areas: Macroeconomic shifts and business cycle turns; policy and political changes; scientific and technological inventions; health and demographic transitions; business model innovations; or even environment and natural events. MRP’s research uses only publicly-available data, filtered through proprietary screens and analytical tools. We’ve also begun to incorporate on-chain analytics into our research process as part of our Weekly Crypto Wrap.

The Importance

of a Theme

Joe Mac’s view is that a significant component of alpha is derived from getting the big picture right – sector, industry, and theme. This view has shaped MRP’s research, and is fundamental to our process.

MRP’s Rob Davis explains how we are able to provide a thematic investment idea based on daily current events, news and macro research. With most alpha being generated by getting “the big idea” correct, Rob explains why identifying the right theme is the most important part of the process.

What’s Included

How we deliver our research.

The DIBs Report

The Daily Intelligence Briefing (DIBs) report is MRP’s premier offering, serving as a daily deep dive into subjects undergoing a transformational change that MRP is examining to determine if there is an opportunity to generate alpha. The subjects change every day and will often serve as an update on topics and sectors previously explored. We share this report with our All-Access clients who may already have or may be considering exposure in the industries affected.

Each Friday’s DIBs is a recap of the week and combined with the Macrodeck. The generation of the DIBs and other products is a process employed and developed by Joe McAlinden over his 50 plus-year, Wall Street career. More about Joe here.

Clients subscribe as an efficient way to stay current on these kinds of subjects, and also follow Joe’s thoughts on the markets, MRP’s Active Themes and other insights.

MRP's Macrodeck

MRP’s Macrodeck is a daily aggregation of key data points, news articles, and other information moving markets. We use this data to inform our own macro outlook and develop new insights, charts, and other research content to share with our clients.

The Macrodeck comes FREE with an MRP Basic membership, and is also apart of our Pro and All-Access Offerings.

The DIBs Report

Daily Intelligence Briefing

The DIBs report is a compilation of articles and data from multiple sources on subjects reflecting disruptive change that have potential investment implications for an industry or group of securities. We share this report with our clients who may already have or may be considering exposure in the industries affected. The subjects change daily and constitute an excellent update on featured topics.

Every day, the DIBs will also include links to Joe Mac’s Market Viewpoints, as well as our current investment themes.

Joe Mac's Market Viewpoint

Joe Mac’s Market Viewpoint is a monthly report in which Joe shares his outlook on macro topics. The Viewpoint is available as part of our Pro package and is also included in the All-Access membership.

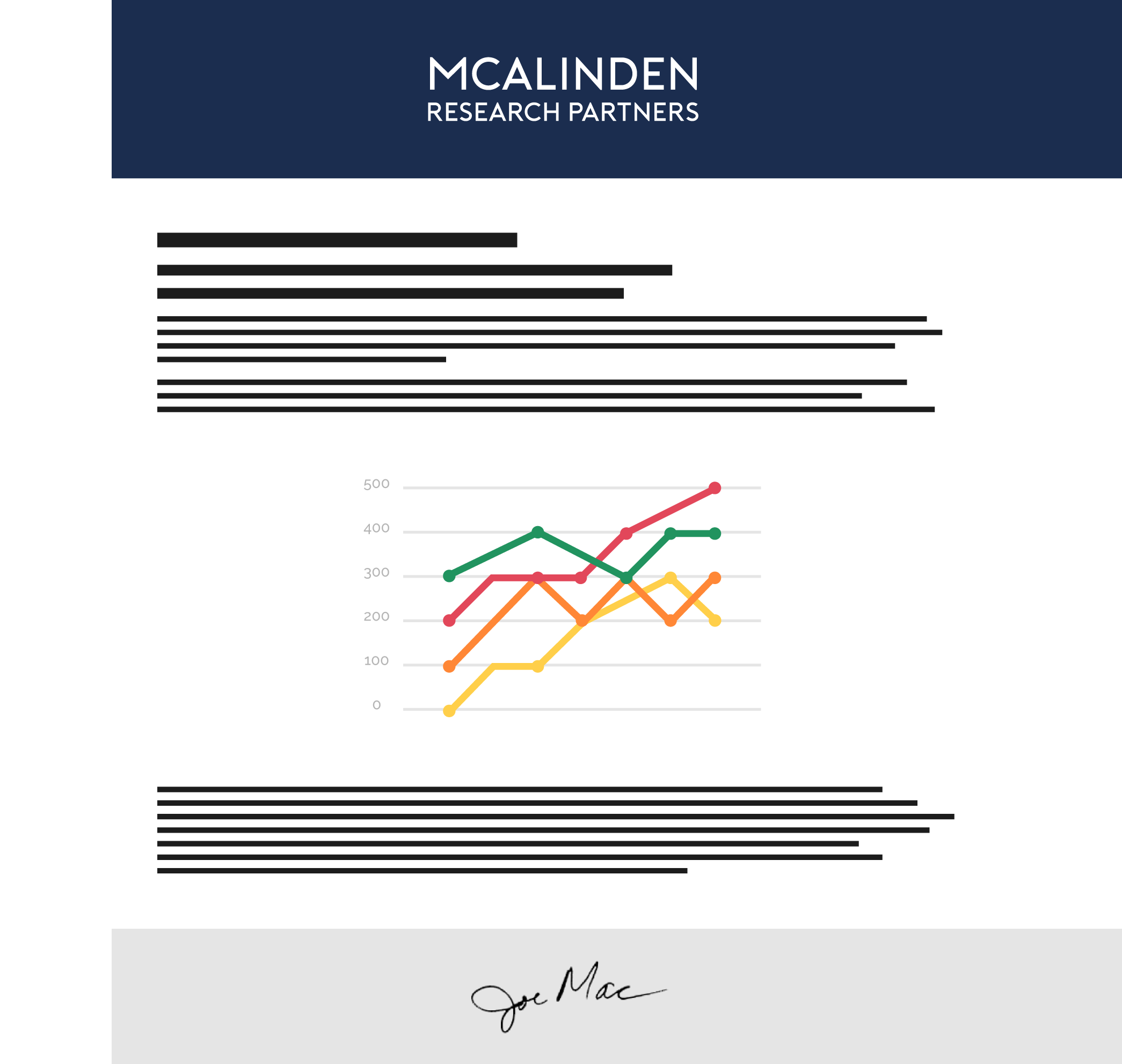

In May 2020’s Viewpoint, for example, MRP correctly identified the prospect of a V-shaped recovery in the wake of the COVID-19 pandemic that we expected would “generate a wave of inflation through 2021”. Joe argued that a massive monetary debasement, by way of a burgeoning expansion of the Fed’s balance sheet, would undoubtedly produce price pressures above and beyond what we’ve seen through all of the last decade. By our January 2021 report, we were able to estimate that “inflation reaching levels in the mid to high single digits” was increasingly likely – in spite of the Fed’s assertion that inflation would remain “transitory”. With growth in the CPI surpassing 7.0% by the end of the year, we closed out 2021 by noting that we are likely entering the “eighth inning” of an equities bull market, making it critical for investors to have a solid grasp on what’s coming next for monetary policy, economic growth, and other macro-oriented topics.

MRP also uses the Viewpoint to highlight developments related to our list of Active Themes. In April 2021, Joe noted that a continued rise in long-term rates would probably slow gains in equities and initiate a broader rotation of capital away from firms with high valuations and toward value stocks. That view was reflective of our SHORT Long-Dated Treasuries theme. Between the end of April 2021 and February 2022, the yield on the US 10-year Treasury had risen from 1.65% to as high as 2.05%.

Weekly Crypto Wrap

MRP’s newest offering is our Weekly Crypto Wrap, available for FREE as part of our MRP Basic membership. It is also included as part of the MRP Pro and All-Access subscriptions.

MRP initiated our research into digital assets in August 2017 and have been gradually scaling up our focus on digital assets for more than four years. In 2021, we produced 13 research reports on digital assets and cryptocurrencies, largely focusing on the Bitcoin and Ethereum blockchains and covering more specific topics like mining, NFTs, and DeFi. This weekly newsletter will go in-depth on information and data points that appeal to investors who wish to gain a broader understanding of the rapidly-growing digital asset economy. The newsletter will be delivered to your inbox every Friday and is similar in structure to the macrodeck, but will focus exclusively on crypto news aggregation, as well as on-chain analysis – a new research strategy that leverages transaction and smart contract information found on public blockchains.

Joe Mac's Market Viewpoint

Market Viewpoint

Joe Mac’s Market Viewpoint is a periodic investment letter in which Joe McAlinden shares his outlook on the markets, U.S. economy, and what that means for an investment portfolio.

In August 2015, for example, Joe established a “Value Over Growth” investment theme. In his Market Viewpoint report that month, he made the case that, after under-performing since the 2008 financial crisis, the value segments of the S&P 500 & the Russell 2000 would soon start to assert themselves and begin a sustained period of out-performance over growth.

Meet Our Founder

And learn how to get in touch with the firm.

Joseph J. McAlinden, CFA

Chairman & Founder

Joe Mac is the Founder, Chairman & CIO of MRP and its parent company, Catalpa Capital Advisors. He has over five decades of research and investment experience. Prior to founding Catalpa Capital, Joe was the Chief Investment Officer and Chief Global Strategist at Morgan Stanley Investment Management for over 12 years, which followed 10 years as the Director of Research & Chief Strategist at Dillon Read & Co. Prior to Dillon Joe served as President & CEO of Argus Research for 16 years, where he started as an analyst recruited from W.E. Burnet & Co.

Joe began his career on the floor of the New York Stock Exchange, received a B.A. cum laude in Economics from Rutgers University and holds the Chartered Financial Analyst (CFA) designation. He has served on the Boards of the Argus Research Group, the New York Society of Security Analysts (NYSSA), the Morgan Stanley Trust, the Convent of the Sacred Heart, and The American Ireland Fund.

Contact Us

420 Lexington Ave

New York

NY 10170

(646) 964-6152

rob@mcalindenresearch.com