|

|

| Thursday, October 11, 2018 |

|

|

|

|

| We've made some changes to our website, click here to get access to past DIBs reports, viewpoints, and an interactive way to explore MRP's ideas. |

|

|

| |

| Today's Featured Topic |

| Coal is at a 6-Year High But Investors are Shunning Coal Miners |

|

|

| The U.S. coal industry has been devastated in the past decade by declining demand and Obama-era environmental policies which prioritized cleaner forms of energy over coal. The Trump administration’s initiatives to save the industry are unlikely to reverse Big Coal’s long-term decline. |

|

|

| Coal has long been a primary source of power in the U.S., but in recent years it has faced stiff competition from cheaper and cleaner alternatives. New discoveries have made natural gas plentiful and cheap, convincing utilities to switch from coal. The rise of renewable energy also poses significant threats to the industry. A decade ago, coal-fired plants provided 50% of the nation’s electricity. Today, coal accounts for less than one-third, and has fallen behind natural gas as the primary fuel for electricity generation.

President Trump has made no secret of his desire to help the struggling coal industry. His energy team has argued that coal is a crucial fuel source and that its decline is a threat to the ability of electricity distributors to supply businesses and consumers. In August, the administration signed a proposal to roll back Obama-era regulation that have contributed to hundreds of coal-fired power plants closing over the past few years.

The new Affordable Clean Energy rule weakens pollution limits on coal-fired power plants and changes the way plants are regulated, prioritizing a measurement of efficiency rather than tracking overall carbon emissions. The goal is to help coal-burning plants compete with natural gas and other cleaner alternatives as a national energy source. Under this proposal, the administration forecasts a 4.5% to 5.8% increase in the production of coal for generating electricity by 2025 compared to what it would have been under the Obama Clean Power Plan.

However, analysts say the Trump proposal is unlikely to alter the industry’s declining fortunes. Simply put, Big Coal is losing customers to natural gas and renewables. Major utilities have committed to reducing carbon emissions and aren't likely to switch back to coal anytime soon. About 93% of the coal produced in the United States is used in power plants. And, more and more coal power plants are closing ahead of schedule due to poor power auction results and high operational costs. The closures are having a ripple effect on coal producers. This week, 150-year old Westmoreland Coal declared bankruptcy, joining other big names such as Peabody Energy, Arch Coal and Alpha Natural Resources that have filed for Chapter 11 protection over the last few years. Back in June, Westmoreland disclosed that one of its major customers, the Conesville coal-fired plant which is scheduled to close early in 2020, would not renew Westmoreland’ coal contracts when they expire at the end of the year.

Since 2010, power plant owners have either retired or announced plans to retire 630 coal plants in 43 states -- nearly 40% of the U.S. coal fleet. No one in the industry is talking about building new coal plants.

So while the Trump administration’s policies have slowed the “bloodletting” that occurred under President Obama, those efforts are not enough to stop the industry’s irreversible decline. Tight margins, declining demand for coal and continuing shutdown of coal-fired plans all confirm that the broad downturn in the coal sector is part of a secular shift toward cleaner forms of energy. The industry has rebounded slightly from a devastating 2016, when cheap natural gas was crushing coal in the power market but the long-term outlook is still negative. Government analysts expect continuing declines, with U.S. coal production, consumption and exports all projected to decrease in 2019, according to the Energy Information Administration.

A year ago, MRP wrote about Peak Coal on the Horizon and provided an updated on June 11, 2018 titled Coal Miners’ Monster Rally Fizzles As New Disruptions Arise. Since the publication of that report on June 11, the VanEck Coal Vectors ETF (KOL) has declined 14% while the S&P 500 has risen 3%. |

|

|

| We've also summarized the following articles related to this topic in the Commodities section of today's report.

Coal |

- The Real Cash Cow in Mining Isn’t Metals. It’s Bad Old Coal

- Westmoreland Chapter 11 marks 4th major US coal company to declare bankruptcy

- The end of coal could be closer than it looks

- World Bank branch to prefer private banks that exit coal

|

|

|

|

|

| |

| Disruptive Change Updates |

|

|

| Markets |

| Crytpocurrencies Bitcoin's Price Went Bust But Not Demand For Cryptocurrency Trading |

| FX Currency War Costing U.S. Manufacturers |

|

|

| Services |

| Cannabis Walmart Canada Ponders Selling Cannabis-Based Products |

| Luxury Retail Luxury Stocks LVMH, Tiffany, Michael Kors Dive On China Slowdown, Crackdown |

| THEME ALERT Video Games Will Google’s “Project Stream” Jumpstart the Cloud Gaming Market? |

| Waste Management Market forces put America’s recycling industry in the dumps |

|

|

| Commodities |

| Ethanol Here’s what Trump’s ethanol plan means for farmers, refiners and motorists |

| THEME ALERT Lithium The Lithium Cartel Is Self-Destructing |

| LNG Big Oil’s Bet on Natural Gas Is a Slow Burn |

| LNG Is This China’s First Defeat In The Trade War? |

|

| Economics & Trade |

| Eurozone Italy’s Banks Stumble Into a New Crisis |

| India Downgrade Risks Surge for India's Earnings Outlook on Oil, Rupee |

|

|

| Technology |

| Augmented Reality NASA is using HoloLens AR headsets to build its new spacecraft faster |

|

|

| Transportation |

| THEME ALERT Autos Rising Interest Rates Start to Repel Car Buyers From Showrooms |

| THEME ALERT Autos Sales Down 18% at VW, Latest Auto Maker Dented by Emissions Rules |

|

|

| Biotechnology & Healthcare |

| THEME ALERT CRISPR CRISPR cures inherited disorder in mice, paving way for genetic therapy before birth |

| THEME ALERT Pharma Generic Pharma Slides Despite Bullish View On Biosimilar Efforts |

| THEME ALERT Pharma Trump to sign law allowing FTC to scrutinize biosimilar deals |

|

|

| Endnote |

| Government Debt How have the government debt-to-GDP ratios changed since 2006? |

|

|

|

|

| |

| Joe Mac's Market Viewpoint |

|

|

|

|

| FX Matters The dollar's ups and downs have had significant repercussions. The earnings of global companies, the trend of interest rates, commodity prices, and many nations’ economies – emerging markets in particular – have all been impacted. This issue of MRP’s Viewpoint first examines the forces driving the dollar’s fluctuations, then looks at where the buck might go next and offers some thoughts on what it could mean for the capital markets.

Joe Mac's Market Viewpoint: FX Matters → |

|

|

|

|

|

|

|

|

|

|

| LONG ASEAN Markets |

|

|

| LONG Defense |

|

|

| LONG Industrials |

|

|

| LONG Materials |

|

|

| LONG Palladium |

|

|

| LONG Steel |

|

|

| SHORT U.S. Housing |

|

|

| LONG Video Gaming |

|

|

| SHORT Autos |

|

|

| LONG Electric Utilities |

|

|

| LONG Lithium |

|

|

| LONG Obesity |

|

|

| LONG Robotics & Automation |

|

|

| LONG TIPS |

|

|

| SHORT U.S. Pharmaceuticals |

|

|

|

| LONG CRISPR |

|

|

| LONG Gold & Gold Miners |

|

|

| SHORT Long-Dated UST |

|

|

| LONG Oil & U.S. Energy |

|

|

| LONG Solar |

|

|

| LONG U.S. Financials & Regional Banks |

|

|

| LONG Value Over Growth |

|

|

|

|

|

|

|

|

|

|

| US Stocks Plummet as Rout Extends

Wall Street closed sharply lower on Wednesday 10 October 2018 to record the biggest drop since February as the sell-off triggered by rising yields continued and the tech rout extended, with Netflix falling 8% and Amazon 5%. The Dow Jones lost 832 points or 3.2% to 25599. The S&P 500 retreated 95 points or 3.3% to 2786. The Nasdaq plunged 316 points or 4.1% to 7422. TE |

|

|

| US Producer Prices Rebound in September

Producer prices for final demand in the US rose by 0.2 percent in September 2018, following a 0.1 percent fall in August and in line with market expectations. Producer prices rebounded due to higher cost of services (0.3 percent), driven by transportation and warehousing services (1.8 percent) and trade (0.1 percent).

On the other hand, cost of goods declined 0.1 percent, after being unchanged in August, mostly due to a decrease in energy (-0.8 percent). The core index, which excludes food and energy, went up 0.2 percent in September, rebounding from a 0.1 percent fall in August, and matching market consensus.

On a yearly basis, producer prices grew 2.6 percent and the core index increased 2.5 percent. TE |

|

|

| US Mortgage Applications Drop in Latest Week: MBA

Mortgage applications in the United States fell 1.7 percent in the week ended October 5th 2018, following a flat reading in the previous period, data from the Mortgage Bankers Association showed. Refinance applications declined 2.6 percent and applications to purchase a home fell 1.1 percent. The average fixed 30-year mortgage rate jumped by 9bps to 5.05 percent, the highest since February of 2011. TE |

|

|

| Oil Prices Fall 2%

Oil prices declined on Wednesday, tracking sharp losses in Wall Street and after the IMF cuts its global growth forecasts on Tuesday. Price drop comes despite a report showing Iran crude exports fell more than expected in the first week of October and after Hurricane Michael caused temporary shutdown in production. The US crude was down 2.1% to $73.35 a barrel and the Brent crude declined 1.8% to $83.59 a barrel around 12:30 PM NY time. TE

|

|

|

|

|

| Disruptive Change Updates |

|

|

|

|

| |

| Markets |

| Crytpocurrencies Bitcoin's Price Went Bust But Not Demand For Cryptocurrency Trading

Even though cryptocurrencies have gone boom and bust, TD Ameritrade (AMTD) says its clients are still eager to get into Bitcoin trading as speculators rotate out and retail investors rotate in.

In December, TD Ameritrade opened Bitcoin trading on the CBOE (CBOE) Futures Exchange, becoming the first financial services firms to do so. Since then, Bitcoin vaulted to about $20,000 in December 2017 (after starting the year near $1,000), then lost about two-thirds of its value. On Tuesday, it was about $6,600, with price volatility near a 15-month low, according to CoinDesk.

But as Bitcoin trading and other cryptocurrency futures come online at regulated exchanges, there is now more price discovery, said JB Mackenzie, TD Ameritrade's managing director of futures and forex, referring to the way competing buyers and sellers determine a price.

Reports say lower price volatility in a maturing market is curbing demand from speculators, who profit from moves up and down. But TD Ameritrade finds interest among retail clients remains strong as Bitcoin prices stabilize after recent sharp swings.

As a result, the online broker is looking beyond the hugely popular Bitcoin with its investment in a new regulated exchange. Dubbed ErisX, the exchange will offer access to cryptocurrency futures and spot contracts on a single platform. Its initial offering could include derivatives of Etherium and Litecoin. IBD |

| FX Currency War Costing U.S. Manufacturers

Already tariffs are driving down productivity and raising costs for U.S. manufacturers. Daimler recently reported that tariffs led to profits shrinking from $2.9bn to $2.09bn in the second quarter. The challenges extend beyond tariffs to wild fluctuations in exchange rates.

Whether the Chinese Yuan was depreciated by design, or as a result of market responses to the trade war, it has put U.S. manufacturers exporting to Chinese markets at a further disadvantage. U.S. manufacturers need not be passive victims. There are several straight forward steps that every business should take to effectively assess currency exposure and hedge to reduce.

Working with foreign exchange experts allows a business to hedge its currency—where exchange rates can be locked in for a period of up to two years. Moreover, specialists in foreign exchange offer much better rates for currency transfers than most high street banks simply by the virtue of the expertise that comes from working on foreign exchange markets day in day out.

It is too simplistic for a business to see itself as an exporter or importer. The realities of a global supply chain mean that in a period of fluctuation, it appears the only winners are those that deploy an effective FX strategy. Mnet |

|

|

|

|

| |

| Economics & Trade |

| Eurozone Italy’s Banks Stumble Into a New Crisis

Rome’s populist administration has sent yields on government bonds soaring by passing a budget that busts the EU’s fiscal rules. And since Italian banks still hold hefty amounts of those bonds, investors have taken fright, dumping the lenders’ shares.

The consequences of prolonged turmoil shouldn’t be underestimated. Banks could restrict credit, which would weigh on the economy. And were one of the weakest lenders to get into serious trouble, the Italian government would face some unhappy choices. That could cause a widespread loss of confidence.

Bad loans made up 11.4 percent of the total loan book in the second quarter of 2018, down from 15.2 percent in the same period last year, according to Bank of Italy data. Some of the banks in worst shape, such as Veneto Banca and Banca Popolare di Vicenza, have been shut down.

Investors had taken heart from what they’d seen; a sectoral index including Italian banks rose by more than 80 percent. But the formation of a populist coalition in May between the Five Star Movement and the League has halted the rally. The same index has lost more than 30 percent over the past five months.

As lenders have significant exposure to Italian debt, they are highly sensitive to changes in the credibility of the Italian sovereign. An increase of 100 basis points in the sovereign spread between Italy’s bonds and Germany’s bunds reduces the Common Equity Tier 1 capital of Intesa Sanpaolo SpA and UniCredit SpA, the country’s two largest banks, by 35 basis points. B |

| India Downgrade Risks Surge for India's Earnings Outlook on Oil, Rupee

The rupee’s longest rout since 2000 and oil’s surge to a four-year high have put earnings estimates of Indian companies at the risk of downgrades. Analysts have boosted the average profit forecast for NSE Nifty 50 Index companies by 9.2 percent this year, shrugging off a 12 percent slump in the gauge since August. But history suggests the divergence won’t extend for long, and the growing stress in Asia’s third-largest economy may soon translate into lower projections.

Not that a weaker rupee is bad for all Indian companies -- exporters including software producers and drugmakers will gain in local-currency terms. Still, the net impact on the broader corporate sector may be negative because of higher import bills. Add to that the tighter local-funding conditions, and profit estimates begin to appear optimistic.

Demand in the world’s fastest-growing major economy is cooling after back-to-back rate increases by the central bank, prompting policy makers to pause the hiking cycle in October despite the currency’s free fall. A default by a systemically important non-banking finance company aggravated the sell-off in stocks, which were already reeling under a tumbling rupee and elevated prices of crude oil -- the nation’s top import. B |

|

|

|

|

|

| |

| Services |

| Cannabis Walmart Canada Ponders Selling Cannabis-Based Products

Walmart Inc.’s Canadian arm has been investigating the possibility of selling cannabis-based products but doesn’t intend to get into the much-hyped business yet. The company also has no plans to dispense medical marijuana at its pharmacies “at this time,” Medeiros said.

Interest in CBD has been booming as Canada prepares to legalize recreational marijuana next week and several large alcohol and consumer products companies have indicated they’re studying CBD’s commercial possibilities.

Coca-Cola Co. said last month that it’s “closely watching the growth of non-psychoactive CBD as an ingredient in functional wellness beverages around the world.” Constellation Brands Inc., the maker of Corona beer and Robert Mondavi wine, has indicated an interest in selling CBD-infused drinks through its partnership with Canopy Growth Corp., and Molson Coors Canada Inc. has formed a joint venture with Hexo Corp. to develop cannabis beverages. When PepsiCo Inc. said last week that it has no plans to invest in cannabis, its shares took a dip.

Other Canadian retail outlets are moving into the pot space. Shoppers Drug Mart, the drugstore chain owned by Loblaw Cos., last month received approval from Health Canada to become a licensed medical marijuana producer, opening the door for its pharmacies to dispense medical cannabis to patients. B |

| Luxury Retail Luxury Stocks LVMH, Tiffany, Michael Kors Dive On China Slowdown, Crackdown

Amid concerns of slowing demand from Chinese consumers and a government crackdown in China on luxury goods, shares of several luxury retail stocks are getting slammed Wednesday, including LVMH (LVMUY), Tiffany (TIF), Michael Kors (KORS) and Tapestry (TPR).

LVMH — parent of Louis Vuitton, Christian Dior, Sephora and other brands — is down 7.8% after disclosing a deceleration in revenue growth late Tuesday. (The stock trades on the Euronext Paris under the ticker LVMH and on U.S. over-the-counter markets as LVMUY.) Organic sales rose 10% during LVMH's third quarter, down from 11% and 13% in the previous quarters, according to the Wall Street Journal.

And Bloomberg said that on the LVMH call, management essentially confirmed worries that customs officials in China are being strict in border checks of Chinese citizens returning home from abroad. The duty-free import limit is on goods worth up to 5,000 yuan, or approximately $722, according to the outlet.

Fellow luxury consumer stocks, including high-end jeweler Tiffany & Co., cosmetics giant Estee Lauder (EL) and affordable-luxury handbag and apparel chains Michael Kors and Coach-parent Tapestry are also down sharply in the stock market Wednesday. IBD |

| Video Games Will Google’s “Project Stream” Jumpstart the Cloud Gaming Market?

Alphabet's Google recently revealed Project Stream, a cloud gaming platform for streaming high-end video games in the Chrome browser. Google stated that selected participants would need home internet connections of at least 25 megabits per second, as well as Google and Ubisoft accounts. Google posted a demo video on YouTube showing the platform streaming Assassin's Creed Odyssey at 60fps at a 1080p resolution -- which is comparable to the performance of a high-end gaming PC.

Google is arriving late to the party, since Sony (NYSE:SNE) already launched the world's largest cloud gaming platform with PS Now, and NVIDIA launched two versions of its GeForce Now cloud gaming platform for its Shield devices and PCs. HP also offers a cloud gaming service for its Omen gaming PC owners, while Microsoft recently started testing Project xCloud, a game streaming service for Xbox consoles, Windows PCs, and mobile devices which it plans to launch next year. Electronic Arts is also reportedly developing its own cloud gaming platform.

However, what sets Project Stream apart from those services is that it doesn't require the installation of any additional front-end software. Instead, Google can merely use Chrome, the most widely used internet browser in the world, as a launchpad for its cloud gaming platform. TMF

|

| Waste Management Market forces put America’s recycling industry in the dumps

A crash in the global market for recyclables is forcing communities to make hard choices about whether they can afford to keep recycling or should simply send all those bottles, cans and plastic containers to the landfill. Cities and towns that once made money on recyclables are instead paying high fees to processing plants to take them. Some financially strapped recycling processors have shut down entirely, leaving municipalities with no choice but to dump or incinerate their recyclables.

It all stems from a policy shift by China, long the world’s leading recyclables buyer. At the beginning of the year it enacted an anti-pollution program that closed its doors to loads of waste paper, metals or plastic unless they’re 99.5 percent pure. That’s an unattainable standard at U.S. single-stream recycling processing plants designed to churn out bales of paper or plastic that are, at best, 97 percent free of contaminants such as foam cups and food waste.

The resulting glut of recyclables has caused prices to plummet from levels already depressed by other economic forces, including lower prices for oil, a key ingredient in plastics.

The three largest publicly traded residential waste-hauling and recycling companies in North America — Waste Management, Republic Services and Waste Connections — reported steep drops in recycling revenues in their second-quarter financial results. Houston-based Waste Management reported its average price for recyclables was down 43 percent from the previous year. AP |

|

|

|

|

| |

| Technology |

| Augmented Reality NASA is using HoloLens AR headsets to build its new spacecraft faster

Traditionally, aerospace organizations have replied upon thousand-page paper manuals to relay instructions to their workers. In recent years, firms like Boeing and Airbus have started experimenting with augmented reality, but it’s rarely progressed beyond the testing phase. At Lockheed, at least, that’s changing. The firm’s employees are now using AR to do their jobs every single day.

Spacecraft technician Decker Jory uses a Microsoft HoloLens headset on a daily basis for his work on Orion, the spacecraft intended to one day sit atop the NASA Space Launch System. For now, the longest he can wear it without it getting uncomfortable or too heavy is about three hours. So he and his team of assemblers use it to learn a task or check the directions in 15-minute increments rather than for a constant feed of instructions.

Lockheed is expanding its use of augmented reality after seeing some dramatic effects during testing. Technicians needed far less time to get familiar with and prepare for a new task or to understand and perform processes like drilling holes and twisting fasteners. MIT |

|

|

|

|

| |

| Transportation |

| Autos Rising Interest Rates Start to Repel Car Buyers From Showrooms

Rising interest rates are putting pressure on U.S. auto sales and approaching the point where they will turn buyers away from new vehicles, according to the head of the National Automobile Dealers Association.

Rising interest rates are putting pressure on U.S. auto sales and approaching the point where they will turn buyers away from new vehicles, according to the head of the National Automobile Dealers Association.

Interest rates on car loans are approaching 6 percent, up from as low as 2.5 percent, Lutz said. That is creating an affordability problem and driving buyers into used cars, he said. Auto sales will ultimately decline more rapidly unless automakers take steps to address rising new car prices, he said.

“This should be concerning for everyone because the new vehicles are more fuel efficient and they’re safer, and the goal is to get those vehicles on the road to eliminate the old vehicles,” said Lutz, who has a Chrysler, Jeep, Dodge and Ram store in Jackson, Michigan. “If we price these vehicles out of the reach of most consumers, we’re not doing ourselves any good with pollution or gas mileage or safety. It’s important that the manufacturers get it right.” B |

| Autos Sales Down 18% at VW, Latest Auto Maker Dented by Emissions Rules

Sales at Volkswagen AG’s namesake brand fell more than 18% last month, making the German auto maker the latest in the industry to be affected by new emissions-testing rules in Europe.

European car makers cut prices through the summer to unload old models that weren’t compliant with the new emissions rules, prompting some consumers to bring forward purchases, thus cutting into September demand. Some new models also weren’t certified in time to meet new regulations. The European Union has been tightening testing procedures for new vehicles in the wake of Volkswagen’s 2015 admission that it had rigged millions of diesel vehicles to cheat emissions tests. As part of that effort, the World-wide Harmonized Light Vehicle Test Procedure regulations, which measure pollutants, greenhouse-gas emissions and fuel economy, went into effect in Europe on Sept. 1.

Volkswagen said Tuesday it sold 485,000 vehicles world-wide in September, down from 593,700 a year earlier, with sales in Western Europe falling 46%. It also recorded a nearly 11% drop in China—Volkswagen’s largest market—that the company blamed on trade tensions with the U.S.

Volkswagen’s downbeat sales figures came a day after Daimler AG’s Mercedes-Benz brand reported an 8.2% drop in September sales. On Friday, Volkswagen’s premium brand Audi AG said sales fell 22% last month. WSJ |

|

|

|

|

| |

| Commodities |

| Coal The Real Cash Cow in Mining Isn’t Metals. It’s Bad Old Coal

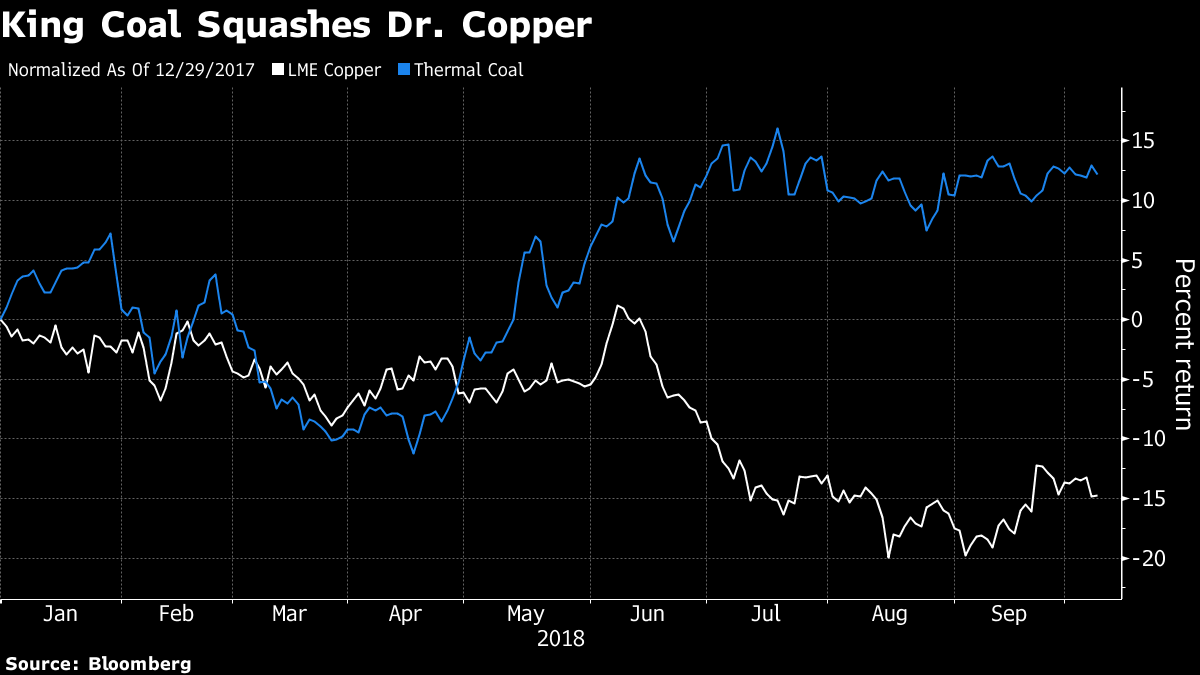

Base metals from copper to zinc have tumbled this year, caught up as a proxy for trade fears and emerging market jitters. Meanwhile, coal has ground steadily upwards, supported by strong demand from top commodities user China, and is trading near the highest in more than six years.

Glencore Plc is in touching distance of seeing its coal mining profits eclipse copper earnings this year for the first time since it sold shares in London in 2011. Anglo American Plc’s coal earnings almost trebled in the last four years, despite lower production. The fuel is forecast to contribute a whopping 43 percent of Anglo’s profits this year despite it operating some of the best platinum, diamond and copper mines in the world.

It wasn’t supposed to be this way. Almost everyone in metals is universally bullish on copper. Coal, on the other hand, has been widely shunned by both investors and many producers.

One explanation is that coal is susceptible to strong price swings. Unlike most other commodities, the vast majority of the fuel is produced in the country it’s burned, near power stations. The global seaborne market of about 1 billion tons is less than a fifth of total production, meaning small swings in demand can have a disproportionate impact on price. B |

|

| Coal Westmoreland Chapter 11 marks 4th major US coal company to declare bankruptcy

The declining coal sector has claimed another victim, with Westmoreland Coal announcing on Tuesday that it was filing for Chapter 11 protection in the U.S. Bankruptcy Court for the Southern District of Texas. The company has $1.4 billion in debt, and said it had reached a restructuring support agreement with a group of lenders holding a majority of its loans. Company officials said Westmoreland has launched a business transformation initiative aimed at increasing cash flow by identifying savings from "operational, commercial and overhead efficiencies."

Westmoreland was incorporated more than 150 years ago, but the decline in demand for coal has been a challenge for many big names. Also filing for bankruptcy in the last few years years are Peabody Energy, Arch Coal and Alpha Natural Resources.

Westmoreland's decision to file for bankruptcy highlights the tight margins the coal industry is dealing with today. The supplier's bankruptcy announcement comes just days after American Electric Power revealed it would shutter its 1,590 MW Conesville coal generation facility in Ohio — the plant is a major customer of Westmoreland's, according to S&P Global. UDive |

| Coal The end of coal could be closer than it looks

The world’s electrical utilities need to reduce coal consumption by at least 60 percent over the two decades through 2030 to avoid the worst effects of climate change that could occur with more than 1.5 degrees Celsius of warming, the Intergovernmental Panel on Climate Change announced Monday.

Such a target seems wildly ambitious: Even Bloomberg New Energy Finance, which tends to be more optimistic than other analysts (and more accurate) about the speed of energy transition, expects coal-fired generation to increase by 10 percent over that period.

However, U.S. coal-power generation decreased by about a third in the seven years through 2017, to 12.7 billion British thermal units from 18.5 billion. In the European Union, black-coal generation fell by about the same proportion over just four years through 2016 to 385,925 gigawatt-hours from 544,279 GWh. Across Europe and the United States, the decline in coal output recently has averaged close to 5 percent a year. If the world as a whole can reach 7 percent a year, it would be on track to meet the IPCC’s 2030 target.

The mainstream view is still that we can’t decarbonize our electricity system fast enough to meet the IPCC’s targets. But a decade ago, the current situation of plateauing demand for coal and car fuel and cratering renewables costs looked equally outlandish. Given the way the world’s energy market has changed in recent years, it’s a good idea to never say never. JapanTimes |

| Coal World Bank branch to prefer private banks that exit coal

Commercial banks with big coal investments risk being overlooked for World Bank money, a key official announced on Monday. Its International Finance Corporation (IFC) will “proactively seek” clients committed to moving away from coal. Any client that continues to invest in coal will be required to publicly disclose the value of their stakes.

That was the strategy IFC chief Philippe Le Houérou outlined in an article for Devex as the bank held its annual meeting in Bali, Indonesia. “I believe that IFC and other development finance institutions must move urgently with new ideas to preserve our planet,” he wrote. “We have no choice but to be bold.”

The bank ruled out new direct investment in coal projects back in 2013. Its last exception to that rule, Kosovo C power plant, is understood to be under review. However, it has continued to indirectly support coal through IFC lending to banks and financial institutions.

The way emerging economies like China, India and South Africa meet their growing energy needs is critical to meeting international climate goals. Coal plants have traditionally been seen as the cheap and easy option, but they are polluting and can run for 40 years. CCNews |

| Ethanol Here’s what Trump’s ethanol plan means for farmers, refiners and motorists

President Donald Trump’s plans to allow the sale of a higher concentration of ethanol in gasoline throughout the year would appease U.S. corn farmers who have been stung by low corn prices as a result of the U.S.-China trade dispute and likely even lead to lower prices at the pump. Some refiners and older car engines, however, may pay the price.

Trump is expected to announce a directive later Tuesday that would allow the year-round sale of gasoline with up to 15% ethanol, also know as E15. That would include the use of the blend even during the summer driving season. Its use in the summer months is currently banned as it can produce more smog.

It would help to push corn prices higher and benefit farmers, and it may even help to lower prices for gasoline, but it would hurt refiners who don’t have the ability to blend ethanol—and there are also concerns about the impact of E15 in car engines. The Environmental Protection Agency has a warning label on E15, warning motorists not to fill up with that type of gasoline blend if their car was made before 2001. MW

|

| Lithium The Lithium Cartel Is Self-Destructing

The electric-battery metal is trading at its lowest levels in two years. After doubling in 2016 and rising another third last year, lithium carbonate swap prices for Asia are down 30 percent so far this year. If that wasn’t bad enough, look at what just happened to Ganfeng Lithium Co., the world’s second-biggest producer. Its Hong Kong initial public offering has been priced at HK$16.50 a share, the company announced Wednesday, at the bottom of a target range that went as high as HK$26.50.

Still, it left a hefty share of the issue in the hands of LG Chem Ltd., Samsung SDI Co. and four Chinese state-linked companies who were acting as cornerstone investors and had subscribed for a fixed dollar amount, plus an additional 2 million shares which were placed with a unit of state-owned Guotai Junan International Holdings Ltd.

Tianqi’s aggressive deal-making, plus the connections between the Chinese government and both its chairman and Ganfeng’s, make the lithium market look increasingly like a state-linked cartel. Producers’ cartels ought to be good for the prices of the raw materials they sell, but that’s not really what’s happening here. China isn’t interested in lithium for its own sake, after all, but because it’s a key ingredient for the rechargeable-battery industry that Beijing wants to develop.

As such, the government aims to ensure ample supplies, which keeps prices low and maximizes the profits of the battery-makers and electric-vehicle companies it really cares about. Investors in lithium producers are typically counting on the opposite outcome: a situation where demand runs well ahead of supply and keeps prices high. B |

| LNG Big Oil’s Bet on Natural Gas Is a Slow Burn

Oil companies are betting on natural gas as the fuel of the future—and working hard to ensure new projects deliver profits of the future. Royal Dutch Shell PLC last week announced a liquefied natural gas project in Canada that will cost $14 billion to build, while Exxon Mobil Corp. and partners are expected to approve a multibillion-dollar LNG project in Mozambique in 2019. That is a similar timeline to Russia’s roughly $20 billion Arctic LNG-2 project, which is part-owned by France’s Total SA.

Natural-gas projects historically have delivered lower returns than oil projects, leading companies and shareholders to prioritize oil developments. That’s something the companies are working hard to change. Still, According to Wood Mackenzie, the weighted average internal rate of return for liquefied-natural-gas projects currently in the pipeline is about 13%. That compares with 20% for deep-water projects and 51% for unconventional oil developments like shale.

Yet oil firms have little choice but to double down on gas. Companies have discovered fewer large new oil deposits than natural gas opportunities over the past decade. And rising global demand also makes a compelling case for natural-gas investment.

By 2025, both Shell and PLC will be producing more gas than oil. French giant Total’s production is near 50-50 split. Exxon is also planning significant new investments in LNG. WSJ |

| LNG Is This China’s First Defeat In The Trade War?

The two new forces in the global liquefied natural gas (LNG) market—the United States as a supplier and China as a buyer—are locked in an escalating trade war, which saw Beijing slapping a 10-percent import tariff on imports of U.S. LNG. Although the levy is lower than China’s initial threat of a 25-percent tariff, it is bound to influence the LNG market in the short-term with winter coming in the northern hemisphere, and in the long-term with shifting trade routes.

The Chinese tariff could prompt non-U.S. suppliers of LNG to charge from Chinese buyers on the spot market higher prices that would be just below the U.S. LNG price with the 10-percent tariff. This higher LNG pricing could cost Chinese buyers—mainly the state-held giants PetroChina, Sinopec, and CNOOC who are the most active on the market—an additional US$4 million to US$5 million in expenses on procuring LNG.

The tariff that China imposed on U.S. LNG cargoes could backfire on Beijing, which will have to pay higher prices for LNG from non-U.S. sources. In addition, if Chinese buyers can’t swap the U.S. cargoes, they still have to pay more for U.S. LNG due to the tariff. However, China is thought to have mostly procured all its needed LNG supplies for the coming winter. OP

|

|

|

|

|

| |

| Biotechnology & Healthcare |

| CRISPR CRISPR cures inherited disorder in mice, paving way for genetic therapy before birth

Nearly 40 years after surgeons first operated on fetuses to cure devastating abnormalities, researchers have taken the first step toward curing genetic disease before birth via genome editing: scientists reported on Monday that they used the genome editing technique CRISPR to alter the DNA of laboratory mice in the womb, eliminating an often-fatal liver disease before the animals had even been born. And while CRISPRing human fetuses is years away, at best, the success in mice bolsters what Dr. William Peranteau, who co-led the study, calls his dream of curing genetic diseases before birth.

Simon Waddington of University College London, a leader in research to develop fetal gene therapy who was not involved in the new study, called the CRISPR approach “an elegant refinement of the brute-force technology” that’s been the focus of animal studies of fetal genetic therapy.

The scientists hope to study fetal base editing for other severe congenital diseases. It remains to be seen whether this technique or conventional gene therapy, which provides an entire replacement gene, will work better. STAT |

| Pharma Generic Pharma Slides Despite Bullish View On Biosimilar Efforts

Mylan (MYL) stock gapped down Tuesday, touching a 12-month low, as investors digested the generic pharmaceutical company's biosimilar strategy and upcoming third-quarter report. Mylan stock sank 2%, to 34.61, after earlier plunging as much as 6.3% in higher-than-average volume. Meanwhile, shares of other generic pharmaceutical companies slipped a fraction.

Last week, a Mizuho analyst downgraded Mylan stock on her outlook for U.S. biosimilars. Evercore analyst Umer Raffat, on the other hand, says the biosimilar strategy is early. In total, Mylan could grab approvals for 17 potential biosimilars and complex generics from 2018 to 2024, Raffat said.

Raffat doesn't put much emphasis on generic asthma inhaler Advair, which would knock off the branded drug from GlaxoSmithKline (GSK). The Food and Drug Administration is likely to approved Mylan's generic later this month. But Raffat says it only has a small tail. Other copycat drugs "have a real tail and most are multibillion (dollar) products," he said. "Advair is the opposite: It's a massively shrunk and heavily discounted product, where the brand has already locked in aggressive brand-for-generic contracts ahead of wherever Mylan enters."

Sales of the EpiPen, an injector for emergency allergic-reaction medicine, have been tracking about 20% lower than normal, Raffat said. Investors have worried that Teva Pharmaceutical (TEVA) could take share after the FDA approved its generic version of the EpiPen in August. IBD |

| Pharma Trump to sign law allowing FTC to scrutinize biosimilar deals

President Donald Trump signed a bill into law Wednesday requiring drugmakers to send details of biosimilar deals to the Federal Trade Commission for antitrust scrutiny. The legislation will tweak the Medicare Modernization Act of 2003 governing generic drugs to include biosimilars for FTC review of settlements between biologic and biosimilar developers. Additionally, the new law will ban so-called gag clauses that prevent pharmacists from telling patients when paying out-of-pocket instead of through insurance for drugs would be cheaper.

The biosimilar addition was part of the Patients Right to Know Drug Prices Act, one of two laws the president signed Wednesday. The other bill enacted into law was the Know the Lowest Price Act, which also dealt with gag clauses.

In the still-developing area of U.S. biosimilar law, this revision provides a morsel of clarity on the regulatory framework drugmakers can expect from the agency tasked with enforcing the nation's antitrust laws. Michael Perry, a partner at the law firm Baker Botts, recently said the law wouldn't have a huge impact on the industry, but does help clarify the FTC's authority on reviewing such deals. BPDive

|

|

|

|

|

| |

| Endnote |

| Government Debt How have the government debt-to-GDP ratios changed since 2006?

WSJ |

|

|

|

|

|

| |

| |

| The new MRP website has been posting Featured Topic articles daily since its creation in April, included in each is a link to an archived version of that day's DIBs report. There are also over two years' worth of Joe Mac's Market Viewpoints. We've indexed all of this content using the categories you find the DIBs articles filed under, as well as overarching trends such as 'oil' or 'housing.' If it relates to one of our current themes, the content will be marked accordingly. You can use these labels to filter content on the website, and get to what you're interested in faster. There's also a search bar at the top to find what you're looking for under your own terms. Access is only available to MRP clients so you'll need to register on the website to see our articles.

This link will bring you to the registration page, it will ask you for some details and prompt you to select a username and password which you'll use to log into the website in the future. The page is password protected:

Password: 'dibs' |

|

|

| |

| About the DIBs and McAlinden Research Partners

McAlinden Research Partners (MRP) publishes daily and other periodic reports on the economy and the markets.

MRP focuses on identifying change in the global economy and offering an investment thesis whenever an opportunity arises that has not yet been recognized by the market. The DIBs are MRP's compilation of articles and data from multiple sources on subjects reflecting change that have potential investment implications for an industry or group of securities. We share these with our clients who may already have or may be considering exposure in the industries affected. The subjects change daily and constitute an excellent update on featured topics. |

|

|

| The information provided in this Report is not to be reproduced or distributed to any other persons. This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication. |

|

|

|

|

|

|

|

|