|

|

| Wednesday, November 21, 2018 |

|

|

| Use the links below to navigate the report |

| ﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉ |

|

|

|

|

|

|

| At first glance, housing data for October seems to be a mixed bag. Closer inspection, however, along with oncoming headwinds in the coming months, paint a much bleaker portrait. Affordability continues to decline, and mortgage rates are set to keep climbing with the Fed determined to keep tightening. Additionally, materials and labor costs continue to rise with no end in sight.

Read More + |

|

|

| |

|

|

| Change-Driven Themes: Updates on Previous Featured Topics |

|

|

| Economics & Trade |

| ASEAN THEME ALERT These Are the Asian Countries That Benefit From the Trade War |

| ASEAN THEME ALERT Tech giants Microsoft and Google will help train 20 million young Southeast Asians by 2020 |

| Read More + |

|

|

| Manufacturing & Logistics |

| Robotics & Automation THEME ALERT Kroger and Ocado to build first robotic warehouse in Cincinnati |

| 3DP MTC and NASA partnership underway for space additive manufacturing technologies |

| Read More + |

|

|

| Transportation |

| Autos THEME ALERT China’s auto market could hit sales ceiling soon |

| Drones Now We Can Charge An Aircraft Wirelessly From The Ground While It’s In Flight |

| Read More + |

|

|

| Energy & Environment |

| Renewables Clean Energy Growth: Too Fast, Not Enough, Or Just Right? |

| Read More + |

|

|

| Endnote |

| Startups Game Changing Startups 2019 |

| Read More + |

|

|

|

|

|

|

| |

| Joe Mac's Market Viewpoint |

|

|

|

|

| A Review of Our Change-Driven Themes → MRP believes professional investors would be well-served to focus on themes in all market environments. It is the identification of change-driven themes that is our mission at MRP. So, in the face of the recent market turmoil, an update of our own themes is in order. Since March we have added 6 new themes and also eliminated 6. Currently, we have a total of 22 themes that are active. A review of all those active themes follows.

Joe Mac's Market Viewpoint: A Review of Our-Change Driven Themes → |

|

|

|

|

|

|

|

|

| Select a theme to see recent Featured Topics we've written about it |

|

|

|

|

|

|

|

|

|

|

| US Building Permits Fall Less than Expected

Building permits in the United States fell 0.6 percent from the previous month to a seasonally adjusted annual rate of 1,263 thousand in October 2018, while markets were expecting a bigger 0.8 percent drop. Single-family authorizations declined 0.6 percent to 849 thousand and multi-family permits went down 0.5 percent to 414 thousand. Permits for September were revised to 1,263 thousand from 1,241 thousand. TE |

|

|

| US Housing Starts Rise Slightly Less than Expected

Housing starts in the US increased 1.5 percent from a month earlier to an annualized rate of 1,228 thousand in October of 2018, following an upwardly revised 5.5 percent drop in September and compared with market expectations of a 1.6 percent rise. The multi-family segment led the rise while construction of single-family houses declined for a second month. TE |

|

|

| US Stocks Extend Sharp Losses on Tuesday

Wall Street closed deeply in the red on Tuesday 20 November 2019, as trade policy uncertainty and extended declines in tech stocks continued to weigh on investor sentiment. The Dow Jones plunged 552 points or 2.2% to 24466. The S&P plummeted 49 points or 1.8% to 2642. The Nasdaq tanked 120 points or 1.7% to 6909. TE |

|

|

| European Shares Slump

European stock markets closed deep in the red on Tuesday with tech stocks closing at 17-month lows and bank shares dropping to over two-year lows amid concerns over slowing economic growth. In addition, a slump in oil prices and news that Renault’s CEO Carlos Ghosn was arrested in Japan also weighed. TE |

|

|

| Oil Prices Slump

Oil prices sank to the lowest in many months on Tuesday, amid increasing concerns of a global economic slowdown and supply levels. The plunge follows gains in the previous session and coincides with a sell-off in Wall Street. Investors await an OPEC meeting on December 6th to see if major oil producers agree on a cut in output. The US crude declined 4.3% to $54.26 a barrel, the lowest since November 10th 2017 and the Brent crude fell 5% to $63.55 a barrel, the lowest since February 13th, around 12:40 PM NY time. TE |

|

|

|

|

|

|

|

|

| |

| THEME ALERT |

| Housing Hurdles Trip up Builders: Affordability in Decline, Rates on the Rise, and Stalling Starts → |

|

|

| At first glance, housing data for October seems to be a mixed bag. Closer inspection, however, along with oncoming headwinds in the coming months, paint a much bleaker portrait. Affordability continues to decline, and mortgage rates are set to keep climbing with the Fed determined to keep tightening. Additionally, materials and labor costs continue to rise with no end in sight. |

|

|

| The National Association of Home Builders’ monthly confidence index plunged eight points to 60 in November, its lowest reading in over two years. The 8-point drop is a sharper fall than any during even the worst parts of the housing crisis a decade ago. While this reading is still technically positive, the index is down over 23% from its December 2017 peak.

It appeared that housing starts, released a day after the NAHB sentiment, signaled a rebound, rising 1.5% MoM. However, a closer look at the results shows that most of this growth came on the back of apartments and other multifamily housing. Multifamily unit starts cannot be relied upon for a clear picture of housing market strength due to their inherent volatility. Last month, for instance, October saw multifamily starts jump 10.3%, only partially offsetting September’s 15.6% decline. However, stronger multifamily unit growth than usual going forward could be a symptom of deteriorating affordability in single family units. It is currently cheaper to rent than to buy a home across 2/3 of all US counties.

Single-family starts were actually 1.8% lower than in the prior month, which is especially discouraging considering September’s data was hit hard by Hurricane Florence’s landfall, setting back many planned projects in the Southeastern US. The lack of rebound effect brings the resiliency of the market further into question. At a seasonally adjusted annual rate, starts declined 7.4% over the six months through October while permits fell 14.3%, according to JP Morgan Chase.

Although the National Association of Realtors’ (NAR) Housing Affordability Index has improved a bit in recent months due to extremely high Canadian lumber prices finally beginning to ease, as well as consistent gains in median family incomes, the index still remains well below the average of the prior 12 months, indicating affordability remains a question mark going forward.

Although lumber prices have begun falling, they still remain elevated and tariffs on Chinese imports are increasingly blending into the mix as well. Of the $200 billion worth of Chinese goods the duties effect, roughly $10 billion worth of goods are used by the residential construction sector: floorboards, light fixtures, cabinets, HVAC equipment, washing machines, roofing tiles, tools, cement, doors, kitchen cabinets, granite, and quartz, are just a few on the list. If the situation is not resolved before January, the tariff rate will increase from 10% to 25%. The cost increase to homebuilders will effectively amount to a $2.5 billion tax, per the NAHB. Compounding the materials costs, average hourly earnings for construction workers have surged this year, closing out October with a 3.9% YoY boost, their strongest gain of 2018.

Mortgages are also contributing to lack of affordability. Average rates continue to hover near the 8-year high they hit earlier this month at 4.94%. So far this year, the 30-year-fixed has averaged 4.52%, up from 3.99% in 2017. The FOMC has already voted on 3 rate hikes this year, and next month’s meeting is not expected to help matters, since it is considered very likely that members will vote to hike interest rates for the fourth time to close out the year, possibly sending mortgage rates well above the 5% mark. Further, 3 more rate hikes are planned in 2019.

However, it is worth noting that some speculate a slowing housing market could be exactly what curtails the Fed’s planned path. According to a NAHB estimate, housing accounts for 15%-18% of all economic activity across cycles. Therefore, if the Fed were to push rates higher, subsequently denting affordability even further, they may be shooting GDP growth in the foot.

While it’s true that economic growth could be at risk if the housing market continues its tumble, economic growth is not the Fed’s top concern. The Fed follows a dual mandate, focused on managing inflation and achieving maximum employment; two aspects of the economy which remain very healthy, in contrast to the housing market. The Fed’s preferred inflation gauge, the personal consumption expenditures deflator (PCE), has been running steadily along their 2.0% target for the last several months. With the aforementioned jump in wage growth and unemployment reaching near 40-year lows, the Fed is unlikely to prioritize housing if inflation begins to run too hot.

Upon analysis, there doesn’t seem to be much good takeaway from the housing market. Affordability is truly the key word, and it seems to remain in decline. Therefore, we are re-affirming our Short Homebuilders theme.

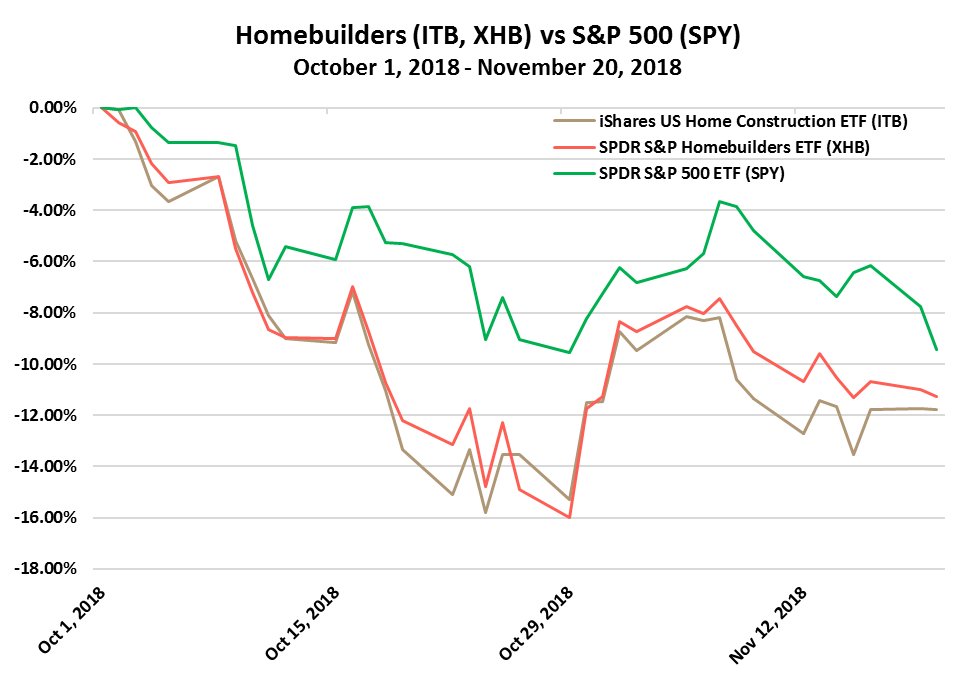

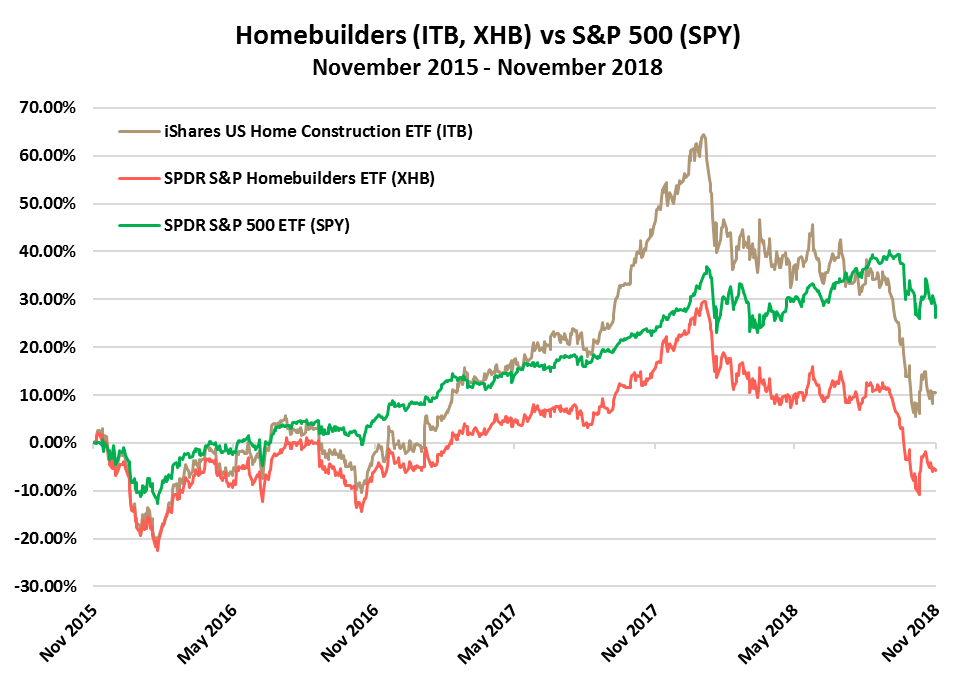

Investors can gain exposure to Homebuilders via the SPDR S&P Homebuilders ETF (XHB), as well as the iShares US Home Construction ETF (ITB). Prior to adding Short Homebuilders, MRP maintained Long US Housing as a theme for more than 6 years until this past May. Over that time, The XHB and ITB returned 146% and 257%, respectively, outperforming the S&P’s 116% gain. |

|

|

| THEME ALERT |

| Since we decided to add it as a short theme on October 1st, the XHB and ITB have declined 11% and 12%, respectively, underperforming the S&P’s 10% loss. |

|

|

| We've also summarized the following articles related to this topic in the Construction & Real Estate section of today's report.

Housing |

- Housing Is Faltering. Maybe the Fed Will Notice

- Housing starts rebound in October but single-family drought lingers

- U.S. housing starts rise, but underlying trend weak

- Here's What $250 Billion in China Tariffs Means for the Design Industry

|

|

|

| Homebuilders (ITB, XHB) vs S&P 500 (SPY) |

|

|

|

|

|

|

|

|

| Change-Driven Theme Updates |

|

|

|

|

| |

| Economics & Trade |

| ASEAN These Are the Asian Countries That Benefit From the Trade War

Asia, at the broad level, will lose from the U.S.-China trade war, but a few countries will emerge as relative winners.

Nomura Holdings Inc. found that a push by companies in the U.S. and China for import substitution towards the rest of Asia will benefit Malaysia in particular, followed by Japan, Pakistan, Thailand and the Philippines, based on its analysis of specific products on the list of tariffs. At the same time, Vietnam is the clear winner from companies switching production from China, followed by Malaysia, Singapore and India.

For BlackRock Inc., Thailand has the advantage in automotive production. The nation is the largest manufacturing center of cars in Southeast Asia, according to the International Organization of Motor Vehicle Manufacturers.

Of the 13 countries in its analysis, Bangladesh, India and South Korea are the least likely to gain from import substitution. Pakistan benefits least from the diversion of production and foreign direct investment. B |

| ASEAN Tech giants Microsoft and Google will help train 20 million young Southeast Asians by 2020

Microsoft, Google and other major technology companies have promised to help provide training in digital skills for around 20 million people in Southeast Asia by 2020 to make sure the region’s burgeoning working-age population is a fit for the future job market. Up to 28 million full-time jobs are subject to being displaced, according to a new estimate.

The World Economic Forum think tank announced on Monday its “Asean Digital Skills Vision 2020” initiative to improve the technological capacity of the 10-member Association of Southeast Asian Nations (Asean) with training, funds for scholarships, internships and shaping the curricula of technology and computing courses, among other measures. The forum is best known for its annual meetings in Davos, Switzerland, of top business and political leaders.

Southeast Asia is seeking to increase the digital skills of its workers as the shift to greater use of robots and other automation threatens to rob those without technological savvy of opportunities for employment, even in manufacturing and service industries.

Other companies pledging training include Cisco, Grab, Lazada Group, Sea Group and Tokopedia. Google leads the pack, with a pledge to train 3 million small-to-medium-size enterprise employees across ASEAN. SCMP |

|

|

|

|

| |

| Politics & Policy |

| Lab Meat FDA and USDA will jointly regulate cell-cultured meat

The U.S. Department of Agriculture and the Food and Drug Administration announced last week that they will jointly regulate cell-cultured meat.

Under the regulatory framework, the FDA will have oversight on cell collection, banks, and growth and differentiation. While cells are being harvested, oversight will transfer to USDA, which will regulate the production and labeling of the resulting food products.

There is still a lot to figure out, including technical details of how the FDA and USDA will collaborate and share information. The deadline to submit comments on how to best regulate cell-cultured meat has been extended to Dec. 26. However, the FDA and USDA said in their statement that since they already have the purview to regulate food and meat products, they do not think separate legislation on the topic is needed.

Nobody has a product on the market yet, but several companies are working on it. JUST has pledged that cell-cultured chicken will be on the menu of some high-end restaurants before the end of the year, and Memphis Meats has set its sights on having products in stores in 2021. And some believe that as soon as technology and regulations develop to inexpensively scale and produce cultured meat, it will cause a permanent change in the industry. FDive |

|

|

|

|

| |

| Construction & Real Estate |

| Housing Housing Is Faltering. Maybe the Fed Will Notice.

Housing starts registered a modest, weather-related uptick in October. But will the Federal Reserve start to pay attention to the longer-run, clear deterioration in the most interest-sensitive sector of the U.S. economy?

New homes under construction rose 1.5% in October to a seasonally adjusted annual rate of 1.228 million units, the Commerce Department reported Tuesday. That, however, masked underlying weakness in the various components of the housing data. Overall starts fell 5.5% in September, partly because of weather, notably Hurricane Florence.

Last month’s tally also was boosted by the highly volatile multifamily housing sector, where starts jumped 10.3%, which partially offset September’s 15.6%. decline. Single-family starts, which comprise the lion’s share of the market, fell 1.8% in October, on top of the preceding month’s 1.0% decline. Building permits, a leading indicator of future home-construction activity, fell for both single- and multifamily structures, for an overall decline of 0.6%.

“Through some of the monthly noise in the data, the trends in both starts and permits have been softening lately in a similar manner to many other housing indicators—starts declined 7.4% [at a seasonally adjusted annual rate] over the six months through October while permits fell 14.3%” at a seasonally adjusted annual rate, JPMorgan Chase said in a research note. Barron’s |

| Housing Housing starts rebound in October but single-family drought lingers

Housing starts ticked up 1.5% to a seasonally adjusted annual rate of 1.228 million in October, the Commerce Department said Tuesday. That was 2.9% lower than a year ago, however. Permits ran at a seasonally adjusted annual 1.263 million pace during the month, 0.6% lower than in September and 6% lower than year-ago levels.

Builders broke ground on more homes in October, but they applied for fewer permits to start work in the future, another reminder that housing market activity is still moving in fits and starts. October’s pace of starts just missed the MarketWatch consensus of a 1.232 million rate.

The government’s data on new residential construction is notoriously choppy and subject to hefty revisions. Figures on starts and permits from prior months were revised up.

But construction activity is clearly slowing. Year-to-date, starts were only 3.9% higher than in the same period of 2017. That year-to-date measurement has been falling steadily throughout 2018.

“With rising mortgage rates and increases in house prices that continue to outstrip disposable income, housing affordability has dropped notably since peaking in 2012,” UBS analysts wrote in a recent note. MW |

| Housing U.S. housing starts rise, but underlying trend weak

U.S. homebuilding rose in October amid a rebound in multi-family housing projects, but construction of single-family homes fell for a second straight month, suggesting the housing market remained mired in weakness as mortgage rates march higher.

Other details of the report published by the Commerce Department on Tuesday were also soft. Building permits declined last month and homebuilding completions were the fewest in a year. Housing starts increased 1.5 percent to a seasonally adjusted annual rate of 1.228 million units last month.

“Rising interest rates and rising home prices are creating affordability challenges that are causing buyers to take pause and re-assess their situation,” said Scott Volling, principal at PwC in Atlanta.

Building permits fell 0.6 percent to a rate of 1.263 million units in October. Economists polled by Reuters had forecast housing starts rising to a 1.225 million-unit pace last month.

The struggling housing market is in stark contrast with the broader economy, which has enjoyed two straight quarters of robust growth and an unemployment rate at a near 49-year low of 3.7 percent. Prolonged housing weakness, together with a relentless sell-off on the stock market could stoke fears over the durability of the economy’s strength. R |

| Housing Here's What $250 Billion in China Tariffs Means for the Design Industry

This past March, when the federal government announced tariffs on steel and aluminum at 25 and 10 percent, respectively, the AIA issued a statement against the increased costs that would be incurred by the design industry. “Any move that increases building costs will jeopardize domestic design and the construction industry,” it stated. At the time, builders had already been suffering from increased lumber prices due to tariffs imposed almost a year prior.

But the trade wars had only just begun. On July 6, more tariffs levied on myriad Chinese imports began, starting with an additional 25 percent duty that largely affected heavy machinery and equipment. Then, on August 23, came a 25 percent duty on a new round of imports, mainly chemicals used in plastics. By September 24, yet another list went into effect, comprising nearly 6,000 more items. This 10 percent tariff, which includes a massive breadth of materials and finished goods used in construction, will be bumped up to 25 percent on January 1.

Already sustaining losses due to increased operating costs, the housing construction industry took a further blow when the new tariffs went into effect. Of the $200 billion worth of Chinese imports this duty levies, roughly $10 billion worth of goods are used by the residential construction sector, according to the National Association of Home Builders. When the rate jumps up in January, warns David Logan, an economist and director of tax policy analysis at NAHB, the cost increase to the industry will effectively amount to a $2.5 billion tax. AD

|

|

|

|

|

| |

| Services |

| Blockchain How Ripple's $50M investment in blockchain research could change U.K. payments

Earlier this year Ripple announced that it has dedicated $50 million toward the University Blockchain Research Initiative (UBRI), partnering Ripple with 17 universities around the globe from the U.K. to Brazil, with the aim of accelerating new innovations in blockchain and cryptocurrencies.

Among the main beneficiaries of Ripple's June investment will be University College London’s world leading Centre for Blockchain Technologies (UCL CBT). Executive director Paolo Tasca predicts the research funded by the UBRI will have an array of potential implications for the U.K. payments market, ranging from streamlining existing interbank payments infrastructures to automating regulation and compliance procedures.

Tasca predicts that one of the first major ways in which blockchain technologies can take hold is by improving the efficiency of regulatory reporting through UCL CBT’s Blockchain Technology for Algorithmic Regulation and Compliance (BARAC) project, which will receive an injection of cash through the UBRI.

“We believe this will be one of the most important blockchain finance projects for the U.K. government,” says Tasca. “The idea is to reverse the current regulatory and compliance models, and use blockchain to allow a layer of communication between regulators and banks, so that regulators can automatically fetch data or query the information they need, without having to rely on an intermediary or the bank reporting that information.” PaySource |

| Retail Retail Stocks Get Crushed Despite Hopeful Sales

A parade of U.S. retail chains on Tuesday reported rising sales in the latest quarter, another sign of healthy consumer spending heading into the critical holiday shopping season. But investors were unimpressed, dumping shares of Target Corp., Kohl’s Corp. and others that released their quarterly results. The selloff, part of a broader market decline, included retailers like Amazon.com Inc. and Walmart Inc. that didn’t report on Tuesday.

A tight labor market and increasing wages have buoyed consumer confidence, prompting Americans to purchase more fashion apparel, flat-screen televisions and homewares. But retail profits have been under pressure from online competition as well as higher spending on worker wages, shipping costs and recent tariffs on Chinese-made imports.

Target reported a 5.1% increase in comparable sales in the third quarter from the same period a year earlier, including a 49% increase in digital sales. However, profit margins declined in the latest quarter as Target spent more on its supply chain and wages. Some analysts said a decline in operating profit is necessary to support Target’s growth.

Best Buy Co., which has been reporting strong demand for electronics in recent quarters, said comparable sales increased 4.3% in the third quarter for its domestic stores and website. It was the sixth straight quarter of comparable growth above 4%. The company’s profit margin, however, slipped on supply chain and other spending. CEO Hubert Joly said the sales growth reflects the company’s efforts to add services as well as the favorable economic environment. WSJ |

| Luxury Luxury Brands See Opportunity in ‘Made in Asia’

A cornerstone of a modern luxury product is the country where it was produced. Attached to the inner lining of a leather handbag, or the collar of a cashmere wool coat, labels like “Made in France” or “Made in Italy” have long been seen as bywords for sophisticated craftsmanship.

However, the recent acquisition of many high-profile brands by Asian investors, coupled with the large number of young Asian creatives now in fashion schools or working their way up in major fashion labels, could eventually prompt a revaluation of the accepted industry order.

Ravi Thakran, group chairman for South and Southeast Asia, Australia and the Middle East at LVMH Moët Hennessy Louis Vuitton, noted that the creative influence of Asian culture and savoir faire had started reshaping sectors of the luxury market such as aviation and hospitality. Fashion, he said, would be next.

“There is a new way to be a luxury brand today,” Cédric Charbit, chief executive of Balenciaga, said. “It is no longer just about heritage and craftsmanship. Those assets are important, but luxury today is also about values,” underscoring the idea that physical provenance could become overshadowed. NYT |

|

|

|

|

| |

| Manufacturing & Logistics |

| Robotics & Automation Kroger and Ocado to build first robotic warehouse in Cincinnati

Kroger Co has chosen its hometown of Cincinnati for the first of 20 high-tech warehouses it plans to build with UK-based Ocado Group Plc in a bid to dominate the U.S. grocery delivery business.

Kroger, the largest U.S. supermarket operator, is battling Walmart Inc and Amazon.com Inc in the small, but fast-growing online segment that accounts for anywhere from 1 percent to 4 percent of the $800 billion U.S. grocery market.

In May, Kroger paid roughly $248 million for a minority stake in Ocado, an online grocer, and struck an exclusive deal for the U.S. market. Kroger will spend $55 million on the partners’ first project - a 335,000-square-foot facility in Monroe, Ohio, a suburb north of Cincinnati.

Kroger said the project, which is expected to create 410 jobs, is subject to securing state and local incentives. The facility is scheduled to open by 2021, a Kroger spokeswoman said.

Amazon was the top online grocery seller before its $13.7 billion purchase of Whole Foods Market last summer that spurred rival grocery sellers to invest in cost-saving automation. Kroger, Walmart and Ahold Delhaize have all now partnered with technology companies that build automated order fulfillment warehouses. R |

| 3DP MTC and NASA partnership underway for space additive manufacturing technologies

Following the establishment of the Additive Manufacturing Benchmarking Center (AMBC) by the European Space Agency (ESA), the Manufacturing Technology Centre (MTC), located in Coventry, UK, is developing a partnership with NASA scientists for technology used on space missions.

“NASA came to us through our collaboration within the ASTM Additive Manufacturing Centre of Excellence and our existing links to the space sector, particularly ESA,” explained David Wimpenny, Chief Technologist at the MTC.

Earlier this year, US scientists from five NASA centers, including the Kennedy Space Centre, visited the MTC. Following this visit, the scientists became interested in becoming involved in projects focusing on the production of complex and high-stress 3D printed components.

NASA is also interested in the MTC’s work on component certification and standards. In addition, the MTC and NASA are also in discussions on technologies including robotic processing, high-temperature alloys, and ceramics.

“The NASA additive technologies team is excited about developing future collaborative opportunities. Our team was extremely impressed with the capabilities and staff at the MTC. Working with the ESA we anticipate utilizing the MTC and the National Centre for Additive Manufacturing as part of our future collaborative efforts.” said Rick Russell, a technologist at NASA. 3DPI |

|

|

|

|

| |

| Technology |

| AI US considers export controls on AI and other new tech

The Trump administration is considering curbs on exports of advanced technologies ranging from artificial intelligence to robotics, as it seeks new means to protect American leadership in innovation from Chinese competition.

On Monday, the commerce department said it was seeking public comment by December 19 on “whether there are certain emerging technologies that are essential to the national security of the US”. The Trump administration could then proceed to impose export restrictions on those products, as the US has traditionally done for military technology and weaponry.

In a document published on the Federal Register, the commerce department listed all the products it might subject to export curbs. These included items from genomics, to computer vision and audio manipulation technology, to microprocessor technology, quantum computing, mind-machine interfaces and flight control algorithms

The move by the commerce department — which was required under the Export Control Reform Act legislation enacted earlier in the year — comes as the trade war between the US and China has escalated well beyond the question of tariffs on industrial goods.

Trump administration officials — and many US business leaders — have grown increasingly concerned at China’s alleged intellectual property theft and forced technology transfer aimed at bolstering Beijing’s drive towards a more innovative domestic economy. FT |

|

|

|

|

| |

| Transportation |

| Autos China’s auto market could hit sales ceiling soon

China’s auto market, which has maintained rapid growth for several years, is racing toward a sales ceiling.

In 2017, the auto market reached a production and sales scale of 29 million units. And while the base has been large, experts say high-speed growth will be difficult to sustain. Low or even negative growth could become the new normal.

Previously, it was estimated that China’s auto sales would hit 35 million units in 2025. However, this figure could shrink to 30 million units, as the compound annual growth rate may be around 2% to 3% in the future, said Wang Yongqing, general manager of SAIC General Motors. Wang thinks when the sales volume is close to 30 million, the car market will hit its ceiling, and sales number will fluctuate and linger around this area.

However, Cui Dongshu, secretary general of the China Passenger Cars Association, believes it will take another 20 years to reach the ceiling, as the per capita possession of cars is relatively low. AsiaTimes |

| Drones Now We Can Charge An Aircraft Wirelessly From The Ground While It’s In Flight

GET, Global Energy Transmission, a US-based corporation with its engineering center in Russia, has been working on distant wireless power transmission — or charging wirelessly at distances greater than what we are used to. What this means is that an electric drone could recharge while in flight. Depending on the power source of the charger and the drone’s energy capacity, the aircraft could fly indefinitely.

GET’s distant wireless charging would happen via a high-power in-flight rapid recharging system that GET is working on that it calls a “power hotspot.” GET says its distance wireless charging technologies, called the GET Distant Wireless Power Technology, and its GET Air can transfer up to 12 kW at a distance of 8 meters (over 26 ft). It also claims an efficiency of 80%, presumably at up to 8 meters, which might raise a few questions on efficiency degradation. CT

|

|

|

|

|

| |

| Commodities |

| Steel Year-to-Date Steel Capacity Utilization Rate Jumps to 78%

The U.S.’s capacity utilization rate for steel continues tAccording to data from the American Iron and Steel Institute (AISI), the U.S.’s steel capacity utilization rate for the year through Nov. 17 reached 78%, up from 74.2% through the same point in 2017. U.S. steel mills have produced 83.7 million tons of steel through Nov. 17, up from 79.4 million in the same time frame last year.o inch toward that magic 80% benchmark.

For the week ending Nov. 17, domestic raw steel production hit 1.9 million net tons, with a capacity utilization rate of 82.1%. Meanwhile, for the same week in 2017, production was 1.7 million net tons, with capacity utilization rate of 73.3%.

Earlier this year, when the U.S. announced its Section 232 tariffs on steel and aluminum imports, the 80% mark was identified as the goal for the domestic steel and aluminum industries, being the mark at which the sectors are considered profitable and healthy. The capacity rate for 2017 reached 74.3% (through Dec. 30, 2017), up from 70.5% for 2016.

Earlier this month, AISI released its Steel Import Monitoring and Analysis (SIMA), which showed the finished steel import market share for October hit 21%, and was 23% through the first 10 months of the year. MM |

|

|

|

|

| |

| Energy & Environment |

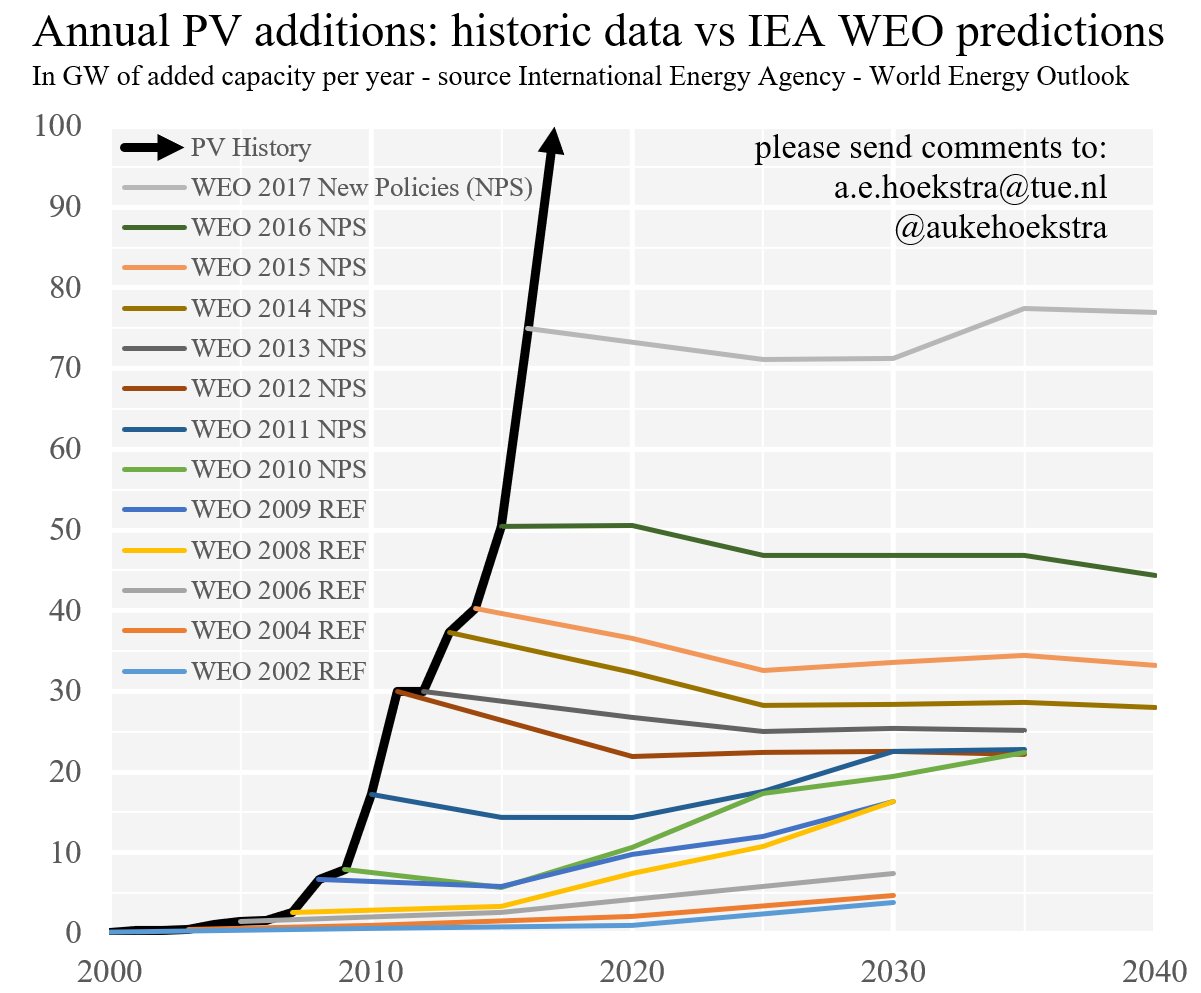

| Renewables Clean Energy Growth: Too Fast, Not Enough, Or Just Right?

An article was published in the New York Times recently about the growth of clean energy production and usage around the world. It focused on the International Energy Agency’s 2018 World Energy Outlook (WEO) report. The IEA’s reported mission is to ensure reliable, affordable, and clean energy for its member countries and beyond. Its main areas of focus are energy security, economic development, environmental awareness, and engagement worldwide. The agency sees 40% of the world’s electrical energy needs being supplied by renewable sources by 2040, up from 25% today.

This is bolstered by the fact that in the last five years, the cost of onshore wind power has dropped by 15% while the average cost of solar has dropped by 65%. Many of you may have read Kyle Field’s recent article about how Tesla is dropping the price of its solar products as another positive indicator of these trends.

But the world is still far from solving global warming, despite impressive recent gains for renewable energy usage around the globe. Global carbon dioxide emissions rose 1.6 percent in 2017. Projections say they are on target for even greater increases in 2018. The report projects that emissions will keep rising slowly until 2040. CT |

|

|

|

|

|

| |

| Biotechnology & Healthcare |

| 3DP 3D-Printed Organs From Living Cells Could Help Boost Senses

Electronics often don’t mesh well with flesh and blood. Cochlear implants can irritate the scalp; pacemaker wires dislodge; VR headsets weigh heavily on the face. That’s why, for the past six years, Michael McAlpine has been Frankensteining alternatives. A mechanical engineer at the University of Minnesota, he creates prototypes of bionic body parts with nice, soft components—some of them alive.

His 3D-printed “ear,” made by enveloping a coil antenna in living matter, requires electrically conductive silver nanoparticles and cartilage-forming cells, while his “spinal cord” calls for neuron-forming cells and a translucent column of silicone. Whatever the desired organ, the computer-guided nozzles take up to an hour to extrude McAlpine’s goopy primordial ingredients into a mold. The result is then given a few weeks to rest in a nutrient-packed bath, which allows the cells to grow around and within any core electronics.

While tests show that his imitation ear can successfully perceive music—a recording of “Für Elise”—he has yet to connect the prosthetic’s radio receivers to a living thing’s nervous system. Same goes for his latest creation, an eye filled with a web of photodetectors that can translate light into electrical signals—a first step to artificial vision. WIRED |

|

|

|

|

| |

| Endnote |

| Startups Game Changing Startups 2019

CBI

|

|

|

|

|

|

| |

| About the DIBs and McAlinden Research Partners

McAlinden Research Partners (MRP) publishes daily and other periodic reports on the economy and the markets.

MRP focuses on identifying change in the global economy and offering an investment thesis whenever an opportunity arises that has not yet been recognized by the market. The DIBs are MRP's compilation of articles and data from multiple sources on subjects reflecting change that have potential investment implications for an industry or group of securities. We share these with our clients who may already have or may be considering exposure in the industries affected. The subjects change daily and constitute an excellent update on featured topics. |

|

|

| The information provided in this Report is not to be reproduced or distributed to any other persons. This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication. |

|

|

|

|

|

|

|

|