|

|

| Daily Intelligence Briefing Identifying Change-Driven Themes |

| Learn More → |

|

|

| Use the links below to navigate the report |

| ﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉﹉ |

|

|

|

|

|

|

| Investors seeking a more defensive positioning have rushed into health care stocks in recent months, as hype about the aging bull market, big tech misses, and troubles in emerging markets hit the tape. Still, the pharma sector faces stiff headwinds in the form of pending state and federal legislation, slower drug price inflation, and rising competition.

Read More + |

|

|

| |

|

|

| Updates on Previous Featured Topics |

|

|

| Markets |

| Cryptocurrencies Some Crypto Investors Find a Way of Playing it Safe |

| Cryptocurrencies Fidelity Is Said to Plan March Launch of Bitcoin Custody Service |

| Read More + |

|

|

| Services |

| Smart Retail Could This Technology Make Amazon Go Stores Obsolete? |

| Smart Retail Amazon to 'revolutionise' shopping with 'virtual changing room' app |

| Video Games THEME ALERT Microsoft reports "largest gaming revenue quarter ever" |

| Read More + |

|

|

| Transportation |

| Autonomous Vehicles Investors Pour Money Into Self-Driving Cars to Capitalize on Data |

| Read More + |

|

|

| Commodities |

| Oil THEME ALERT Global Outages Boost Oil Prices |

| Steel THEME ALERT Iron ore prices are flying |

| Uranium China’s nuclear hiatus may be coming to an end |

| Read More + |

|

|

|

| Economics & Trade |

| Eurozone Italy Caps Tumultuous Year With First Recession Since 2013 |

| Read More + |

|

|

| Labor, Education & Demographics |

| Universal Basic Income With Cash Handouts, India Takes Step Toward Universal Basic Income |

| Chatbots White-Collar Robots Are Coming for Jobs |

| Read More + |

|

|

| Technology |

| 5G Why 5G, a battleground for US and China, is also a fight for military supremacy |

| Blockchain Global Pharma Giant Merck Wins US Blockchain, AI Patent for Product Authenticity |

| Defense THEME ALERT As Hypersonic Era Looms, U.S. 'Absolutely, Positively' Needs This |

| Semiconductors Why RAM Prices Are Through the Roof |

| Read More + |

|

|

| Endnote |

| Brexit Is the market too optimistic? |

| Read More + |

|

|

|

|

| |

| Joe Mac's Market Viewpoint |

|

|

|

|

| The Next Handle → Stocks and bonds have struggled over the last year as yields have risen strongly, but MRP believes this is only the beginning. Further tightening of monetary policy is expected to continue delivering upward pressure on yields as slowing earnings and GDP growth begin to bite.

Joe Mac's Market Viewpoint: The Next Handle → |

|

|

|

|

|

|

|

|

| Select a theme to see recent Featured Topics we've written about it |

|

|

|

|

|

|

|

|

|

|

| US Labor: US Economy Adds the Most Jobs in 11 Months; Wages Rise Less than Expected; Jobless Rate Unexpectedly Rises to 4%

Nonfarm payrolls in the US increased by 304 thousand in January of 2019, following a downwardly revised 222 thousand rise in December and easily beating market expectations of 165 thousand. TE

Average hourly earnings in the US increased by 3 cents, or 0.1 percent, to USD 27.56 in January 2019, after gaining 0.4 percent in December and missing market expectations of a 0.3 percent rise. It is the smallest increase in earnings since February. That left the annual increase in wages at 3.2 percent compared to an upwardly revised 3.3 percent gain in December. TE

The US unemployment rate rose to 4 percent in January 2019 from 3.9 percent in the previous month and slightly above market expectations of 3.9 percent. The number of unemployed increased by 241 thousand to 6.54 million while employment fell by 251 thousand to 156.69 million, following the 35-day partial government shutdown. TE |

|

|

| US Consumer Sentiment Lowest Since Trump's Election

The University of Michigan's consumer sentiment for the US declined to 91.2 in January of 2019 from 98.3 in December, but above a preliminary estimate of 90.7 and market expectations of 90.8. It was the weakest sentiment since President Trump was elected. The end of the shutdown caused only a modest boost in the Sentiment Index. TE |

|

|

| US Manufacturing: Manufacturing PMI Unrevised in January: Markit; US Factory Growth Beats Forecasts: ISM

The IHS Markit US Manufacturing PMI was confirmed at 54.9 in January of 2019, the same as in the preliminary estimate and higher than 53.8 in December. Business confidence about the year ahead reached the highest in three months. TE

The ISM Manufacturing PMI in the US jumped to 56.6 in January of 2019 from an upwardly revised 54.3 in December, easily beating market expectations of 54.2. The manufacturing sector continues to expand, reversing December’s weak expansion, but inputs and prices indicate fundamental changes in supply chain constraints. TE |

|

|

| US Construction Spending Beat Forecasts at 0.8%

US construction spending rose 0.8 percent from a month earlier to a seasonally adjusted annual rate of USD 1.30 trillion in November of 2018, after a revised 0.1 percent gain in October and well above market expectations of a 0.2 percent rise. It is the strongest gain since April. Year-on-year, construction spending grew 3.4 percent. TE |

|

|

| US Wholesale Inventories Rise the Least in 5 Months

Wholesale inventories in the United States increased 0.3 percent month-over-month to USD 654.0 billion in November of 2018, below market expectations of 0.5 percent and following an upwardly revised 0.9 percent rise in October. It was the lowest gain in wholesale inventories since June. Year-on-year, inventories advanced 6.5 percent. TE |

|

|

|

|

|

|

|

|

| |

| THEME ALERT |

| Pending Legislation, Slower Price Inflation and Rising Competition Boost MRP's Short Pharma Theme → |

|

|

| Investors seeking a more defensive positioning have rushed into health care stocks in recent months, as hype about the aging bull market, big tech misses, and troubles in emerging markets hit the tape. Still, the pharma sector faces stiff headwinds in the form of pending state and federal legislation, slower drug price inflation, and rising competition. |

|

|

| More than ever before, the US pharmaceutical industry is on the defensive, weighed down by growing criticism from consumers and policymakers about the cost of prescription drugs.Health spending in the United States is projected to grow 1.0 percentage point faster than annual US GDP over the 2017-26 period. Given that rate, health care’s share of GDP is expected to rise from 17.9% in 2016 to 19.7% by 2026, driven primarily by expenditure on prescription drugs.

Spending on medicines, which currently accounts for 10% of U.S. health spending, is expected to reach over $600 billion on an invoice basis by 2023. Putting this in perspective, consider the case of Massachusetts where the $1.9 billion spent on drugs for just Medicaid patients in 2018 was nearly double the amount spent just 6 years earlier in 2012. The drug inflation problem is not unique to Massachusetts or Medicaid spending; it is a nationwide trend. The share of the public that says prescription drug costs are “unreasonable” has increased from 73% in 2015 to 80% in 2018.

That explains why more than half the respondents (52%) of a Kaiser Family Foundation pollsaid that passing legislation to bring down the price of prescription drugs should be the top priority for President Trump and Congress. Another 38% said it was important, although not a top priority.

Prescription drugs are currently organized through patent monopolies that give 20 years’ exclusivity to treatments. To keep costs down, many policy options have been proposed, including limiting US drug prices to reflect the cheaper rate patients pay in other developed countries, requiring drug companies to be transparent on how prices are set, making it easier for generic and biosimilar drugs to come to market, and allowing the import of drugs from other nations to increase competition.

Some members of congress have even suggested breaking the patent monopoly contracts and licensing medications for generic competition if the prices exceed an international benchmark. Meawhile, Senator Elizabeth Warren advocates creating an Office of Drug Manufacturing to manufacture generic versions of excessively priced or inaccessible drugs.

One option that received overwhelming support (92%) in the Kaiser Family Foundation poll and that is gaining traction in congress is that of having the federal government, specifically the Centers for Medicare and Medicaid Services, negotiate directly with drug manufacturers for lower prices.

Some analysts believe that Big Pharma’s lobbying strength makes it highly unlikely that the government can successfully disrupt the complex behind-the-scenes interactions between drugmakers, pharmacy benefits managers (PBMs), wholesalers, insurance companies and pharmacies that have created the conditions for higher drug costs. Nevertheless, the Trump administration just took its biggest step yet to effectuate change.

A new rule proposed by the Department of Health and Human Services (HHS) seeks to banpayments, called rebates, between drugmakers and middlemen. Under the current system, prescription drug manufacturers offer those rebates as incentives to PBMs to get them to include a particular drug on their lists of coverage. While the savings are usually passed along to health plans, they don’t always make it to the patients consuming the drugs.

Under the new rule, drugmakers would no longer be allowed to pay out those rebates, which are a percentage of a drug’s list price, directly to PBMs. These middlemen would instead receive a fixed fee for their services. Instead, the manufacturers would have to provide those rebates in the form of discounts directly to Medicare and Medicaid patients at the pharmacy counter. On average, the net price of a drug after rebates is 26%-30% lower than the list price set by the manufacturer.

Medicare’s contribution to total U.S. health spending on prescription drugs surged from just 2% in 2005 to 30% in 2017. Following that jump, Medicare has become the second largest payer when it comes to retail prescription drugs in America. The contributions by payers can be broken down as follows: Private insurance (42%); Medicare which covers elderly and disabled individuals (30%), Out-of-pocket retail (14%); Medicaid which covers low-income patients (10%); Other (4%).

Given that Medicare and Medicaid together account for 40% of prescription drug spending, a law that allows them to secure better prices from manufacturers could have a spillover impact on overall retail drug prices. Manufacturers currently pay out more than $100 billion annually in rebates.

NEW REBATE LEGISLATION WILL HIT PBMs

The passing of such legislation would be a game changer for some segments within the pharmaceutical supply chain. Manufacturers should come out okay; an aging population and the rise of chronic diseases ensures that demand for prescription drugs will continue to rise, whereas passing along the rebates to consumers would mitigate public displeasure about their role in extravagant healthcare costs.

In contrast, PBMs such as Express Scripts, OptimumRX and CVS Caremark would see their business model disrupted and experience profit declines since the rebates paid are usually a percentage of a drug’s list price, and therefore represent big business. As drug prices have increased, so too have the revenues of PBMs through the rebate payments. Insurers too are bound to be negatively affected because they receive a share of the rebate payout from PBMs and because some insurers own PBMs. A wave of vertical integrations within the industry has resulted in Cigna (NYSE: CI) owning PBM express Scripts and United Healthcare (NYSE: UNH) owning OptimumRX.

SLOWER DRUG PRICE INFLATION WILL HIT WHOLESALERS

PBMs are not the only middlemen facing headwinds. Prescription drug wholesalers have distribution service agreements with drug manufacturers. The fees wholesalers earn are typically computed as a percentage of the drug’s Wholesale Acquisition Cost (WAC) list price. While prescription brand-name drug prices are still rising, they are doing so at a slower pace. In the generic drug world, prices are actually experiencing some deflation.

Volume growth aside, slower drug price inflation should amount to a corresponding slowdown in profit growth for wholesalers. Data compiled by Iqvia found net prices for "protected brands" — defined as branded drugs on the market for more than two years — rose by just 1.5% in the U.S. last year, below the rate of Consumer Price Inflation. Moreover, invoice prices, which track wholesale acquisition costs, increased by 5.7%, Iqvia found. Market leaders in this segment include AmerisourceBergen (NYSE: ABC), Cardinal Health (NYSE: CAH) and McKesson (NYSE: MCK). These three companies account for more than 90% of all revenues from drug distribution in the United States.

LOSS OF EXCLUSIVITY WILL HIT BRAND-NAME MANUFACTURERS

Meanwhile, manufacturers of brand-name drugs are facing greater competition as patents expire and generics and biosimilars gain ground. The impact of losses of exclusivity in developed markets is expected to be $121 billion between 2019 and 2023, with 80% of this impact, or $95 billion, in the United States. By 2023, biosimilar competition in the biologics market will be nearly three times larger than it is today. This will lead to a $160 billion reduction in spending on brand-name drugs over the next five years than would have occurred if biosimilars did not enter the market. |

|

|

| THEME ALERT |

| MRP added Short U.S. Pharmaceuticals to its list of investment themes on October 27, 2017. Since then the SPDR S&P Pharmaceuticals ETF (XPH) has declined 1.63%, underperforming the SPY’s 4.5% gain over the same period. |

|

|

| We've also summarized the following articles related to this topic in the Biotechnology & Healthcare section of today's report.

Pharma |

- Trump administration proposal takes aim at drug rebates

- On Both Ends of Capitol, Both Parties Warn Big Pharma on Drug Prices

- Charlie Baker takes on Big Pharma

- The GM chickens that lay eggs with anti-cancer drugs

- FDA adviser; Opioid approvals are controlled by Big Pharma

|

|

|

|

|

|

|

|

|

|

|

| |

| Markets |

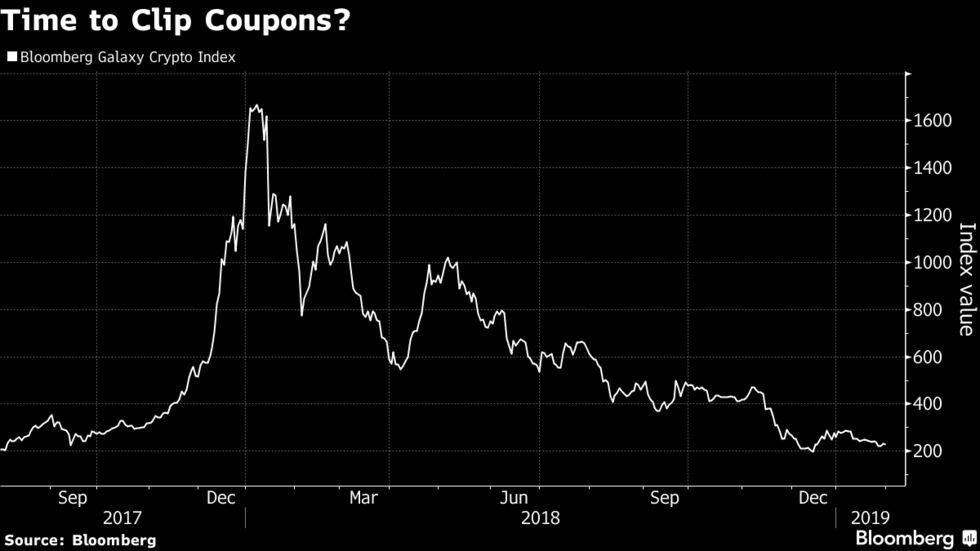

| Cryptocurrencies Some Crypto Investors Find a Way of Playing it Safe

After the volatile cryptocurrency price swings of the last few years, some investors are becoming content with essentially earning interest on their holdings.

They’re embracing a practice known as staking, where their tokens are placed in so-called digital wallets and used to help validate transactions that create new blocks in blockchain networks. In exchange they receive rewards in the form of coins. The proof-of-stake process can generate returns ranging from 5 percent to 150 percent, depending on the coins and amount held.

That’s a big change from how transactions are verified for Bitcoin, which follows a proof-of-work system where so-called miners compete to solve complex mathematical riddles and win new coins. With token prices showing few signs of recovering after plunging as much as 90 percent in 2018, the staking has made it somewhat easier for investors in coins such as Tezos, Decred, Cosmos, EOS and Livepeer to endure the bear market.

"Regardless of market conditions, staking provides returns denominated in the asset being staked," said Kyle Samani, managing partner at Multicoin Capital Management in Austin, Texas. "If you’re going to be long, you might as well stake.” B |

|

| Cryptocurrencies Fidelity Is Said to Plan March Launch of Bitcoin Custody Service

Three months ago, Fidelity Investments, the world’s fourth largest asset manager, announced its digital offshoot and cryptocurrency ambitions. Since then, we’ve had confirmation that Fidelity Digital will focus on custodial, rather than exchange services. Followed by a multi-million dollar investment in a new crypto-exchange by parent company, Fidelity Investments, to underline the point.

Now, according to three separate sources, the launch of the first product, a Bitcoin custody service, is expected to launch in March. Reportedly, Ether custody will be the next product following that.

While custody services are common for conventional financial investments, they have not yet taken hold in the world of Bitcoin. The basic idea is that a trusted third-party takes guardianship of the securities, and stores them in a secure facility.

This, admittedly, counters Bitcoin’s “not your keys, not your coins” mantra, though traditional investors may find this option more attractive for delving into cryptocurrency. Responsibility for the asset moves away from both the investor and the broker, reducing the risk of theft or loss. Hacking of exchanges and theft of digital currency has long been off-putting for Wall Street investors.

Although several startups and exchanges like Coinbase have stepped in to offer custodial services for cryptocurrency, it seems that institutional investors have been holding out for an established asset-management company like Fidelity. WA |

|

|

|

|

| |

| Economics & Trade |

| Eurozone Italy Caps Tumultuous Year With First Recession Since 2013

Italy fell into recession at the end of 2018, capping a year of political turmoil, higher borrowing costs and fiscal tensions that took their toll on the economy.

Output shrank 0.2 percent in the three months through December, following a 0.1 percent decline in the previous quarter, statistics agency Istat said Thursday. That was more than expected, and will put further pressure on the coalition government, which already appears to be fraying.

The contraction was anticipated, particularly after Premier Giuseppe Conte said Wednesday that he expected the fourth-quarter GDP drop. Separate figures showed the euro-zone economy grew 0.2 percent at the end of 2018, matching the pace of the previous quarter, but slower than the first half.

Market reaction to confirmation of the Italian recession was limited. The spread between Italian 10-year bond yields and those of similarly dated German bunds stayed at 240 basis points. The country’s benchmark FTSE MIB index erased earlier gains and was down 0.4 percent.

The euro was little changed against the dollar at $1.1477 as of 11:43 a.m. in Rome. B |

|

|

|

|

| |

| Labor, Education & Demographics |

| Universal Basic Income With Cash Handouts, India Takes Step Toward Universal Basic Income

India unveiled huge handouts for farmers, setting the stage for an election-year spending spree, a possible prelude to implementing a universal basic income in an effort to deal with widespread poverty.

India’s budget for the year starting April 1, which was released Friday, doubled the income at which people have to start paying taxes, while promising payouts to help small farmers. The moves are aimed at shoring up support for Prime Minister Narendra Modi’s party, which hopes to retain control of the world’s largest democracy in elections scheduled to start before May. They could also trigger a bidding war for support at the ballot box.

The planned spending, along with previous handouts, forced the country to miss its fiscal deficit target. It was supposed to hit 3.3% of gross domestic product in the year ending March, but instead will rise to 3.4% of GDP. Next year’s target is also 3.4%, rather than around 3.1%, where it would have been without all the farm aid, said interim Finance Minister Piyush Goyal.

“We are moving towards realizing a new India,” Mr. Goyal said. “An India which is clean and healthy, where everybody would have a house with universal access to toilets, water and electricity, where farmers’ income would have doubled.” WSJ |

| Chatbots White-Collar Robots Are Coming for Jobs

Amelia works at the online and phone-in help desks at the Swedish bank SEB. She also works in London for the Borough of Enfield and in Zurich for UBS . And she can memorize a 300-page manual in 30 seconds, speak 20 languages and handle thousands of calls simultaneously.

Amelia is a white-collar robot. She interacts with customers over the phone, as a chatbot and as a three-dimensional avatar on smartphone and computer screens. When she starts a new conversation, she knows all of a customer’s previous contact history. As The Wall Street Journal reported in March 2018, average call duration at Allstate Insurance call centers dropped to 4.2 minutes from 4.6 minutes after the company deployed Amelia.

Her maker, Chetan Dube, left his professorship at New York University to start IPsoft, an automation software company, convinced that using remote workers in India would be nowhere near as efficient as replacing U.S. and European workers with cloned human intelligence.

Amelia and her kind are not enhancers of labor productivity—like faster laptops or better database systems. They are designed to replace workers. They are not as good as human workers, but they are significantly cheaper. WSJ |

|

|

|

|

| |

| Services |

| Smart Retail Could This Technology Make Amazon Go Stores Obsolete?

Amazon Go's "just walk out" shopping experience requires a store to be outfitted with machine vision, deep-learning algorithms, and an array of cameras and sensors to watch a customer's every move. A start-up called Caper is offering similar technology that is more accessible to more retailers.

Rather than outfit an entire store with such advanced artificial intelligence (AI), Caper puts it into individual shopping carts. It lets supermarkets more easily compete against Amazon without the massive cost necessary to build new stores or retrofit a chain's existing infrastructure. Shoppers put items into AI-powered carts, which identify the products and ring up the total. Interactive screens on the carts not only keep a running tally of the order, but can also direct shoppers to in-store specials.

The technology used by Caper's partners does currently require customers to scan each item into the shopping cart screens, but they're using it to train the deep learning algorithm to enable shopping without scanning.

When they are finished shopping, customers can pay via the screen and leave, encouraging shoppers to bring their own bags into the store and fill them up as they go so you're not stuck at the register still having to bag all their items. Fool |

| Smart Retail Amazon to 'revolutionise' shopping with 'virtual changing room' app

Amazon is developing a fashion app that will “revolutionise” clothes shopping by allowing customers to try on outfits with a ‘virtual mannequin’ created from social media photographs. In a development experts fear will threaten the High Street, the American online giant has lodged a UK patent to scour “selfies” and online calendars to predict clothes a person may like or need.

It would “data mine” pictures saved on a phone or computer to produce an Augmented Reality image of the customer actually wearing clothes on sale, potentially eliminating the need to visit a shop’s changing room.

The app would also analyse photographs and appointments to establish a person’s job, the climate they live in, how they spend free time and suggest outfits for upcoming events or accessories for other things they own. The patent application, seen by the Sunday Telegraph, says customers could swipe to like or dislike garments their mannequin would be shown wearing. Telegraph |

| Video Games Microsoft reports "largest gaming revenue quarter ever"

Microsoft's games revenue increased 8% in the second fiscal quarter, which CEO Satya Nadella declared as the "largest gaming revenue quarter" in the company's history.

In the three-month period ended December 31, 2018, Microsoft earned $4.23 billion in revenue from its games business -- an overall increase of 8% year-on-year. That improvement did not come from hardware revenue, however. Hardware sales actually fell 19% over the same quarter last year, which hosted the launch of the Xbox One X.

Instead, Microsoft drew strength from software and services, which saw a 31% increase in revenue thanks to a combination of third-party sales, Game Pass subscribers, and Xbox Live users. In a call with investors, Microsoft CEO Satya Nadella confirmed that Xbox Live MAUs increased by 8% to reach a record 64 million people across console, PC and mobile. According to Nadella, that included "the highest number of mobile and PC users to date. Xbox Game Pass subscribers and Mixer engagement also hit new all-time highs."

Microsoft also acquired two more development studios in the second quarter: Obsidian Entertainment and inXile Entertainment. It now has 13 internal studios, having doubled its "first-party content capacity" in the space of six months. GI |

|

|

|

|

| |

| Technology |

| 5G Why 5G, a battleground for US and China, is also a fight for military supremacy

Apart from its tremendous commercial benefits, 5G – the fifth generation of mobile communication – is revolutionising military and security technology, which is partly why it has become a focal point in the United States’ efforts to contain China’s rise as a tech power and its allegations against Chinese companies.

The future landscape of warfare and cybersecurity could be fundamentally changed by 5G. But experts say 5G is more susceptible to hacking than previous networks, at a time of rising security concerns and US-China tensions on various interconnected fronts that include trade, influence in the Asia-Pacific region and technological rivalry. These tensions provide the backdrop to controversy surrounding Huawei, the world’s largest telecoms equipment supplier.

Long before the Chinese company was indicted in the US this week on multiple charges including stealing trade secrets and violating US sanctions – charges it denies – US intelligence voiced concerns that Huawei’s telecommunications equipment could contain “back doors” for Chinese espionage. Huawei has repeatedly denied these allegations, but the controversies have underlined 5G’s growing importance and stepped up the technological arms race between China and the US. SCMP |

| Blockchain Global Pharma Giant Merck Wins US Blockchain, AI Patent for Product Authenticity

Merck, the world’s oldest operating pharmaceutical firm, has won a blockchain patent from the United States Patent and Trademark Office (USPTO), Cointelegraph auf Deutsch reported Jan. 30. The German multinational has developed a system that uses a combination of Artificial Intelligence (AI) and blockchain tech to establish the authenticity of unique physical objects.

According the firm, the new patent describes a technology that can identify and record any unique feature of a physical object as its so-called “fingerprint,” including chemical signatures, DNA and image patterns. The company claims that the technology described in the patent can increase the security of systems such as supply chains, aiming to eliminate counterfeit. The tech is reportedly being developed in Merck’s Innovation Center, the firm’s research and development arm.

Citing data from the World Health Organization, Merck noted that more than 50 percent of pharmaceutical products purchased on illegal websites are in fact fake. CoinTelegraph |

| Defense As Hypersonic Era Looms, U.S. 'Absolutely, Positively' Needs This

As China and Russia show off videos of hypersonic missile tests, the U.S. is racing to develop its own versions of the superfast weapons, which can travel more than five times the speed of sound. But Raytheon (RTN) CFO Toby O' Brien believes that defending against hypersonic missile attacks will be a bigger market in the long run.

"At the end of the day, with a new capability from the U.S. perspective, the No. 1 thing is being able to defend yourself against an adversary that has an offensive capability," he told IBD Thursday. "You don't necessarily need the offensive capability. But you absolutely, positively need to defend yourself."

Analysts believe that hypersonic weapons have the potential to be the most disruptive battlefield technology since the advent of stealth, as current missile defenses are unable to stop them.

In August, China reportedly had a successful test flight of a hypersonic vehicle, the Starry Sky 2. And last month, Russian President Vladimir Putin said a new hypersonic missile system will be deployed this year. The hypersonic missile threat was outlined in the Pentagon's Missile Defense Review, released earlier this month. Raytheon is working on some of the new technology outlined in the review, including higher energy lasers as well as hypersonic weapons. IBD |

| Semiconductors Why RAM Prices Are Through the Roof

Typically, the RAM market functions on a cadence that’ll be familiar to anyone who has been building PCs for more than a few years. At debut, a new RAM standard is often far more expensive than the mainstream standard it’s supposed to replace. Meanwhile, the new memory offers few-to-no benefits over the original in most cases. Over time, the clock speed gap grows and costs on the new memory fall. Eventually, the two standards hit parity and the older RAM starts to become more scarce. Ultimately, the new RAM typically bottoms out cheaper than the old memory.

But not this time. Over the past two years, the price of DRAM has skyrocketed. A recent report by GamersNexus found that the cost of a specific DDR4-2400 memory kit has leaped from $81 on 2/22/2016 to $196 today ($196 on January 22, $192 on January 30).

The explanation for this spiking is that mobile demand for DDR4 has stripped the market bare. According to DigiTimes, mobile DRAM inventory levels are spiking at smartphone manufacturers, with some companies carrying 2x the load they were as weak demand for devices and skyrocketing prices bite into smartphone profit margins as well.

GPU prices will probably will come down once the cryptocurrency boom subsides. But as far as RAM prices are concerned, buy only as much as you’re absolutely sure you’ll need. ExTech |

|

|

|

|

| |

| Transportation |

| Autonomous Vehicles Investors Pour Money Into Self-Driving Cars to Capitalize on Data

When it comes to self-driving cars and other autonomous vehicles (AVs), investors are much more interested in the data they’ll collect than the cars themselves.

The self-driving car bubble burst as technological reality fell far behind AV companies’ lofty predictions. But Wall Street investors are still interested in AV companies that come from a more analytics-driven background, according to Axios. The trend suggests that the real value of AVs could be the data on passenger and driver behavior that they generate — and not, counter-intuitively, the technology that’s actually operating the cars.

Axios pointed out that Morgan Stanley analysts recently assigned vastly different values to leaders in the AV space depending on each company’s background: after GM, traditionally a carmaker, announced some delays, Morgan Stanley analyst Adam Jonas argued that the valuation of GM’s AV division should be dropped from $11.5 billion to $9 billion.

Meanwhile Waymo, a subsidiary of Google’s parent company Alphabet, has a stronger data analytics background — Jonas’ colleague Brian Nowak argued that Waymo is worth $37 billion but could quickly rise to $175 billion as AVs become more popular, Axios reports. “The value is in the data and what you can do with it,” Jonas said in the Axios post. Futurism |

|

|

|

|

| |

| Commodities |

| Oil Global Outages Boost Oil Prices

The oil market received a boost from the U.S. Federal Reserve this week, which signaled on Wednesday that it would essentially suspend its plans to hike interest rates this year. Fed chairman Jerome Powell said that economic growth remained “solid” but that the central bank had “the luxury of patience” when deciding on further rate hikes. That is a big change from prior guidance, in which the Fed very clearly outlined multiple rate increases in 2019.

“The case for raising rates has weakened somewhat,” Powell said. Slowing growth in China and Europe, a weakening housing market, tepid inflation – these are not exactly the ingredients that call for aggressive rate tightening. The announcement contributed to strong gains for oil prices on Wednesday and Thursday. At the time of this writing, WTI was trading in the mid-$50s, with Brent above $62 per barrel, both close to two-month highs.

“The market is more convinced that there will be aggressive production cuts and the macro picture has improved a bit. That’s positive for prices going forward,” Jean-Louis Le Mee, CEO of London-based oil hedge fund Westbeck Capital, told the Wall Street Journal.

Oil prices are back up to where they were in November, and significant outages from Venezuela in the short run could pave the way for more price increases. OP |

| Steel Iron ore prices are flying

Top iron ore producer Vale’s decision to decommission its upstream tailings dams following the deadly dam burst on Friday at its facility in Córrego do Feijão, Brazil has lit a fire under iron ore prices.

The Chinese import price of 62% Fe content ore jumped 5% on Wednesday to trade at $82.53 per dry metric tonne, according to data supplied by Fastmarkets MB. The price of the steelmaking raw material is now up more than 13% year to date. The index price for high-grade (65% Fe) Brazilian ore gained $5.40 to reach $97.60 a tonne.

Domestic Chinese prices also surged, with the most actively traded iron ore futures contract on the Dalian Commodity Exchange hitting its daily uplimit to finish Wednesday nearly 6% higher at 587 yuan ($87.40) per tonne, a 17 month high.

Vale’s plans to halt production at 10 operations, cutting its annual output by some 10% or 40m tonnes, upending a market that was expected to experience a year of gentle decline. BMO Capital Markets, a Canada-based investment bank, says 2019 “has gone from a year where we were looking to displace marginal tonnes to one where we will need to incentivise additional higher cost material.” BMO raised its forecast for benchmark prices by 24% to $78 per tonne from $63 per tonne previously and its 2020-2021 price to $70 a tonne. MINING |

| Uranium China’s nuclear hiatus may be coming to an end

Beijing has approved the construction of four new nuclear reactors using a domestically developed design, according to Chinese news reports. If confirmed, the deployment of China’s Hualong One reactor would end a more than two-year hiatus in approvals that had cast a shadow over China’s nuclear enterprise.

China’s Jiemian News started the chatter on Tuesday with an exclusive interview with senior leadership of the Hualong One design’s owner, Hualong International Nuclear Power Technology, a collaboration of nuclear heavyweights China General Nuclear Power (CGN) and China National Nuclear Corp. (CNNC). According to the news site, the joint venture’s leaders said that two dual-reactor projects had received provisional permission to begin pouring concrete.

The reactors are slated for two new sites along China’s coast: CNNC’s Zhangzhou power project in Fujian and CGN’s Huizhou Taipingling project in Guangdong. Both projects had been planned and approved by Chinese authorities with Westinghouse’s AP1000 reactor design, which promises safety advances such as passive cooling. That means it stores water above the reactor, leveraging gravity to keep the plant cool should the pumps fail.

Restarting nuclear reactors of any design in China would be a shot in the arm for the technology globally, since China has recently been nuclear energy’s biggest investor. It would also be a welcome development for energy experts and governments that see nuclear as a crucial low-carbon energy source to accelerate a fossil-fuel phase-out. MIT |

|

|

|

|

| |

| Biotechnology & Healthcare |

| Pharma Trump administration proposal takes aim at drug rebates

The Trump administration on Thursday unveiled a new plan aimed at recasting the role prescription drug rebates play in Medicare, proposing to do away with certain price reductions offered by drugmakers to pharmacy benefit managers, Part D private insurance plans and Medicaid managed care organizations.

The proposed rule would exclude these rebates from currently provided legal protection under the Anti-Kickback Statute. Instead, the administration's proposal would create new legal safe harbors for discounts given directly to patients paying for drugs at the pharmacy counter, as well as for fixed fee agreements between manufacturers and PBMs.

The administration hopes the moves will reduce out-of-pocket costs for patients paying for drugs, and lower Part D spending overall. "This proposal has the potential to usher in the most significant change in how Americans' drugs are priced at the pharmacy counter, ever," said Health and Human Services Secretary Alex Azar in a Jan. 31 statement. BPDive |

| Pharma On Both Ends of Capitol, Both Parties Warn Big Pharma on Drug Prices

Members of Congress from both parties served notice on pharmaceutical companies on Tuesday that the days of unchecked drug-price increases were over and that they would be held politically accountable for exorbitant prices. The new reality became apparent at simultaneous but separate hearings of House and Senate committees where lawmakers said that the relentless increases were unsustainable and unacceptable.

“There is a strong bipartisan consensus that we must do something to rein in out-of-control price increases,” said Representative Elijah E. Cummings, Democrat of Maryland and the chairman of the House Committee on Oversight and Reform. “Drug companies make money hand over fist by raising the prices of their drugs — often without justification and sometimes overnight — while patients are left holding the bill.”

On the other side of the Capitol, Senator Charles E. Grassley, Republican of Iowa and the chairman of the Finance Committee, and Senator Ron Wyden of Oregon, the senior Democrat on the panel, denounced drug company executives who they said had refused to testify voluntarily. Mr. Grassley expressed “displeasure at the lack of cooperation from the pharmaceutical manufacturers” and vowed to insist on their testimony in coming months. NYT |

| Pharma Charlie Baker takes on Big Pharma

Drugs — life-saving drugs — are changing lives, changing the way health care is delivered, and changing the way states, including Massachusetts, are wrestling with the rising public costs of paying for those drugs.

Last week in his proposed 2019-20 state budget, Governor Charlie Baker offered up yet another way to help control those rising prescription drug costs, promising that getting tougher not on MassHealth patients but on pharmaceutical companies could save some $80 million a year. Yes, that’s a big number — but it makes the point that this aspect of Medicaid spending is indeed a big ticket item that needs to be addressed.

If the manufacturer fails to see the wisdom in offering the state rebates to meet its targeted price, the drug company would be subject to a public rate-setting process. If those negotiations are unsuccessful, then drugs priced at more than $25,000 a year per patient (or $10 million in total costs to the state) would be subject to action by the Health Policy Commission that would include disclosure requirements, public hearings, and a possible referral to the attorney general’s office for action under the state’s consumer protection law.

In short, the measure — which would require legislative approval — would allow the state not only to use its buying power but also its bully pulpit to bring down the cost of the drugs it buys. BostonGlobe |

| Pharma The GM chickens that lay eggs with anti-cancer drugs

Researchers have genetically modified chickens that can lay eggs that contain drugs for arthritis and some cancers. The drugs are 100 times cheaper to produce when laid than when manufactured in factories. The researchers believe that in time production can be scaled up to produce medicines in commercial quantities.

The chickens do not suffer and are "pampered" compared to farm animals, according to Dr Lissa Herron, of Roslin Technologies in Edinburgh. "They live in very large pens. They are fed and watered and looked after on a daily basis by highly trained technicians, and live quite a comfortable life. "As far as the chicken knows, it's just laying a normal egg. It doesn't affect its health in any way, it's just chugging away, laying eggs as normal."

Scientists have previously shown that genetically modified goats, rabbits and chickens can be used to produce protein therapies in their milk or eggs. The researchers say their new approach is more efficient, produces better yields and is more cost-effective than these previous attempts. "Production from chickens can cost anywhere from 10 to 100 times less than the factories. So hopefully we'll be looking at at least 10 times lower overall manufacturing cost" said Dr Herron. BBC |

| Pharma FDA adviser; Opioid approvals are controlled by Big Pharma

The chairman of a Food and Drug Administration advisory committee on the approval of new opioids says the agency is bowing to the influence of big pharmaceutical companies who want new powerful new opioids, and ignoring the danger of the drugs to Americans, 72,000 of whom died of overdose in 2017.

Anesthesiologist Raeford Brown told the Guardian that a war is now raging within the FDA over the agency’s policies and practices when reviewing and approving painkillers. Some are pushing for tougher approval guidelines for opioids, while others believe that big drug companies should be granted the chance to bring new drugs to market. Brown says the FDA has failed to learn from its own mistakes, and continues to ignore the abuse risks of new drugs.

“I think that the FDA has learned nothing.” Brown told the Guardian. “The lack of insight that continues to be exhibited by the agency is in many ways a willful blindness that borders on the criminal.”

Trump-appointed FDA chief Dr. Scott Gottlieb said the agency should consider not only the effectiveness of a new opioid, but the need for the drug. He promised “dramatic action” to overhaul the agency’s methods, but the recent approval of another powerful painkiller called Dsuvia has called that pledge into serious doubt. FC |

|

|

|

|

| |

| Endnote |

| Brexit Is the market too optimistic?

The British pound implied volatility has been moving lower as the market becomes more confident that the official Brexit event will be postponed. WSJ |

|

|

|

|

|

| |

| About the DIBs and McAlinden Research Partners

McAlinden Research Partners (MRP) publishes daily and other periodic reports on the economy and the markets.

MRP focuses on identifying change in the global economy and offering an investment thesis whenever an opportunity arises that has not yet been recognized by the market. The DIBs are MRP's compilation of articles and data from multiple sources on subjects reflecting change that have potential investment implications for an industry or group of securities. We share these with our clients who may already have or may be considering exposure in the industries affected. The subjects change daily and constitute an excellent update on featured topics. |

|

|

| The information provided in this Report is not to be reproduced or distributed to any other persons. This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication. |

|

|

|

|

|

|

|

|