To go to MRP's research library, click here. |

|

|

|

|

|

|

|

|

Daily Intelligence Briefing |

|

|

Identifying Change-Driven Investment Themes - Five sections, explained here. |

|

|

|

|

I. Today's Thematic Investment Idea A deep dive into a market driver with alpha generating potential. |

|

|

|

Copper May Be Entering a Golden Moment |

Summary: The coronavirus has disrupted copper mines and delayed new builds, throttling current and future supply. Meanwhile, demand is bouncing back as the world’s biggest consumers of copper reboot their economies. Stimulus packages being unleashed across the developed also promise to transform the long-term outlook, particularly with spending on copper-intensive green energy infrastructure.

Related ETFs: iPath Series B Bloomberg Copper Subindex Total Return ETN (JJC), Global X Copper Miners ETF (COPX) |

|

|

|

|

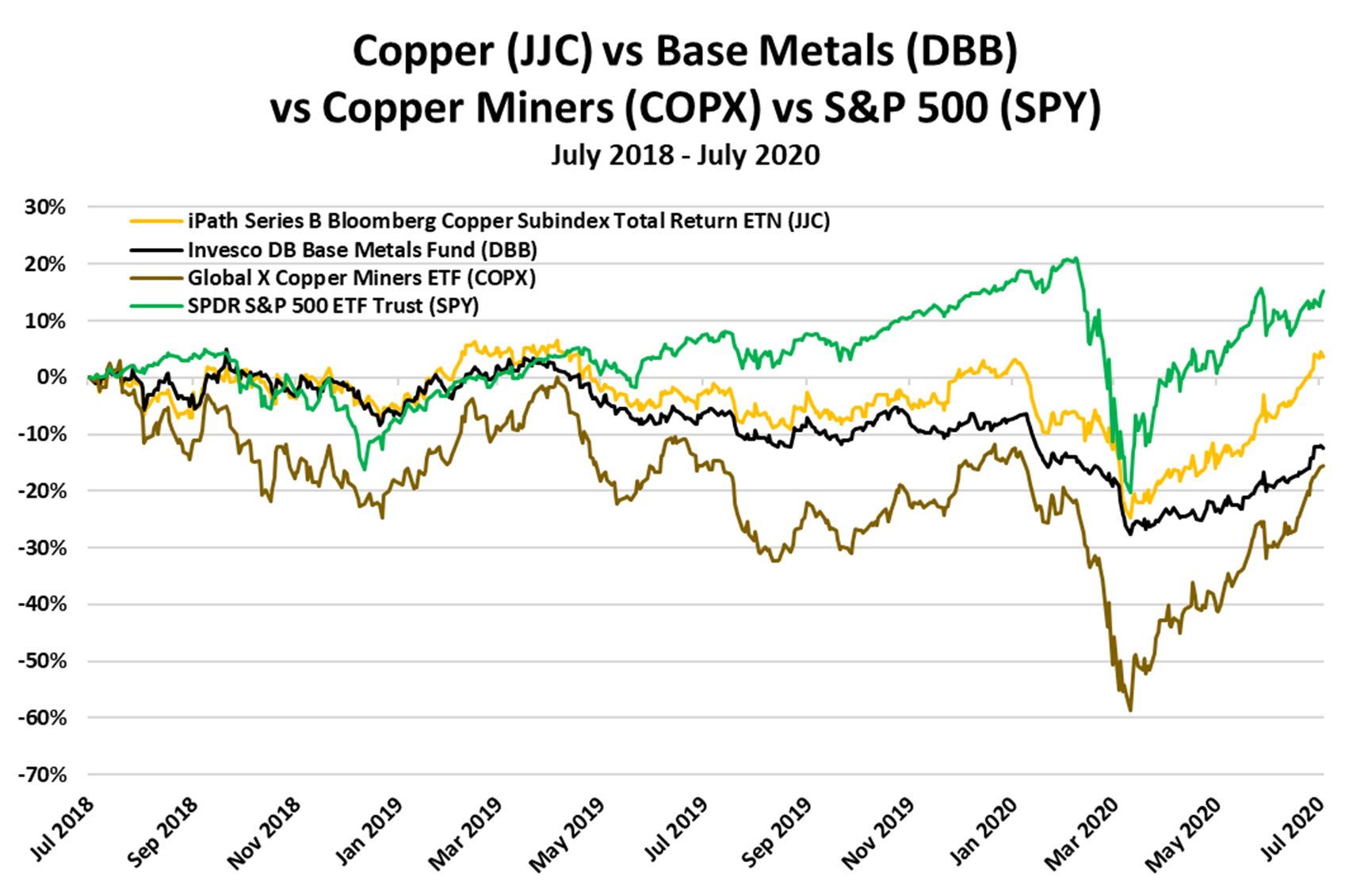

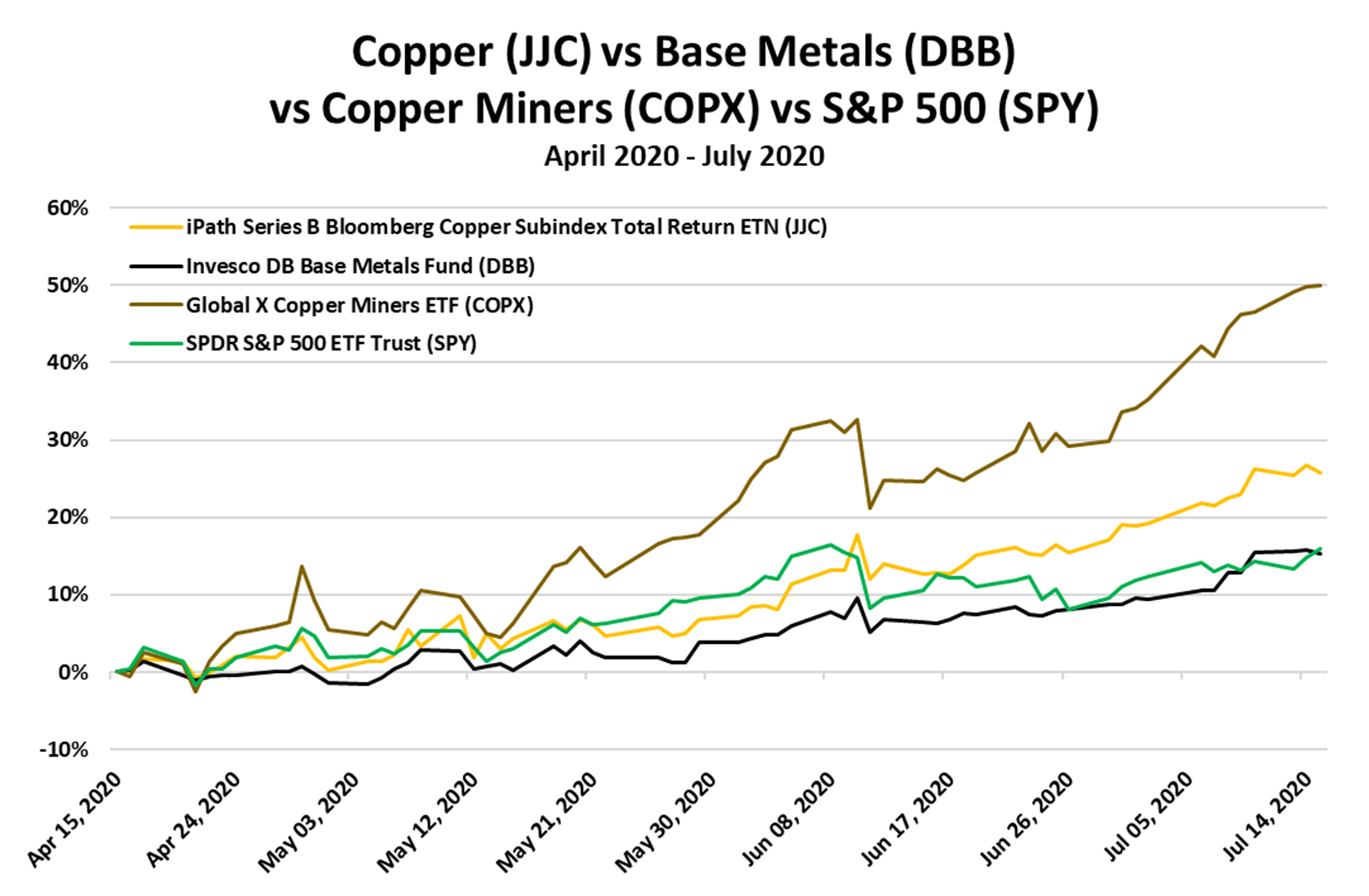

Copper has been on a roll in recent months. Today, the commodity is trading at a price of $2.87 per pound in the spot market, marking a 36% increase from March 22 when copper’s price plunged to a five year low of $2.10 due to a collapse in demand. In the securities market, the copper ETF (JJC) has gained 39% since stocks bottomed on March 23, while the copper miners ETF (COPX) has actually doubled.

Following these impressive gains, we are right back to where we were at the start of the year. Copper’s spot price is just 2% higher than on January 1, 2020, while JJC is up 3% and COPX is down 3%. In comparison, the S&P 500 is flat year-to-date. When looking at performance over a two-year horizon, the copper ETFs still lag the broad market. Over the past two years, JJC returned has +4%, COPX has returned -15%, while SPY returned +15%.

The big question now is whether further outperformance is possible after copper’s recent gains. The answer is yes, based on three factors.

I. Post-Pandemic Recovery of the Global Economy Industrial production is on the rise globally, as businesses resume their operations. Yesterday’s data release from the Fed showed that U.S. industrial output surged 5.4% in June, the most since December 1959, and beating market expectations. Factory production jumped 7.2%, and even more so in the beleaguered auto industry, where production of cars and auto parts surged 105%. Though U.S. capacity utilization increased 3.5 percentage points to 68.6% in June, that rate is below its long-run (1972–2019) average 80.1% and below January’s level of 76.9%, so there’s plenty of room for production expansion. The June ISM Manufacturing PMI index also suggests that factory output will rebound further.

A similar comeback in industrial production is taking place in in China, and in the European Union. China's industrial production rose by 4.8% from a year earlier in June 2020, marking the third back-to-back month of expansion and the largest increase in six months, as factory activity picked up.

This is all positive for copper demand, as those three markets -- China, the EU, and the U.S. -- account for 80% of the world’s annual copper consumption.

II. Global Transition to Low Carbon Economy From a longer-term perspective, copper stands to be a big beneficiary as the world transitions to a low-carbon economy. That’s because renewable systems use about five times more copper than conventional energy systems. Electric vehicles also require 2-4 times more copper than internal combustion-engine vehicles. EV sales and the switch to renewables are only set to grow as many countries, especially in Europe, place the green recovery at the center of their stimulus packages.

Accordingly, copper should experience huge demand in coming years given its potentially expanding role in a green economy. The metal is considered a critical component in practically all green tech, from electric vehicles to wind- and solar-power technology.

III. The Supply Picture

On the supply side, analysts are projecting shortages in the future due to a dearth of investments in new mines. More recently, the pandemic’s rapid spread across Latin America and worker strikes have led to supply disruptions in key producing nations like Chile. That’s likely to result in lower production this year.

With output from some mines limited and demand picking back up, global copper stockpiles have been dropping since March. Inventories of copper in warehouses monitored by the Shanghai Futures Exchange stood at 137,336 tonnes on Friday, which is 64% lower than the peak of 380,000 tonnes reached around March 13. In LME-registered warehouses, copper inventories have fallen to 197,850 tonnes, down about 28% since March 13.

The Bottom Line

As an industrial metal with a wide variety of applications –- from manufacturing to electronics, and construction -- copper is considered a cyclical commodity whose price fluctuates in tandem with economic cycles, rising when the economy grows and falling when the economy slows. As the world’s biggest economies go into recovery mode, and given its potentially expanding role in an increasingly green global economy, copper’s medium-term and long-term outlook appears increasingly positive.

As such, investing in copper now can perform triple duty in an investor’s portfolio. It can serve as a bet on the 2020/2021 global economic recovery, a play on the secular shift from fossil fuels to renewables, and a potential hedge for inflation since copper typically rises when inflation is accelerating.

How to Gain Exposure

Investors can gain exposure to copper’s rise through ETFs that track the metal’s price in the futures market or by investing in copper producers, since the latter stand to benefit from higher prices.

The Global X Copper Miners ETF (COPX) invests in a diversified basket of about 30 copper miners. Meanwhile, the iPath Series B Bloomberg Copper Subindex Total Return ETN (JJC) and the United States Copper Index Fund (CPER) offer exposure to fluctuations in the price of the physical commodity by investing in copper futures contracts. While JJC is structured as an exchange-traded note, CPER is structured as a commodity pool.

Nelly Nyambi Managing Director, Research McAlinden Research Partners |

|

|

|

|

Copper vs Base Metals vs Copper Miners vs S&P 500 |

|

|

|

|

|

|

Source material for today's market insight... |

|

|

Copper Surging Copper Prices Signal Optimism About Global Growth

Global investors are piling into bullish wagers on copper prices, sparking the quickest rally in the industrial metal in years and signaling that many money managers remain hopeful about the economic outlook despite rising coronavirus cases in much of the U.S. Because copper is widely used in the global manufacturing sector and critical to making everything from smartphones to houses, many market watchers use its price as an economic indicator. The metal is closely linked to growth in China in particular. The world’s second-largest economy consumes roughly half of the world’s copper, and recent data indicate a growth recovery there that is stronger than many analysts anticipated after the coronavirus shut down Chinese manufacturing early in 2020. The gains are a boon for diversified mining companies such as Rio Tinto PLC and BHP Group Ltd. (BHP) that have seen the coronavirus pandemic sap demand for their core products. Shares of those companies and copper miners such as Freeport-McMoRan Inc (FCX) and Southern Copper Corp. (SCCO) have surged in the past three months. Demand isn’t the only factor fueling the gains. Analysts project long-term copper shortages due to a dearth of investments in new mines. More recently, mine and refinery disruptions in key producing nations like Chile due to the coronavirus threaten to lower production.

Read the full article from The Wall Street Journal + |

|

|

Copper Copper’s 50% Pandemic Rally Isn’t Scaring Bulls Away Yet

Copper’s rally has had two primary drivers, either of which could be short-lived. First, disruptions at giant South American mines battling virus outbreaks have throttled production and spurred supply concerns. That’s been coupled with intense buying in China as the world’s biggest consumer of commodities emerged from lockdown, with fresh data Tuesday showing Chinese copper imports reached a record last month. For copper skeptics, the argument is simple: The metal that’s so closely tied to global growth shouldn’t be flying so high while the virus is still running rampant and several major economies are in the grips of the biggest recessions in decades or even centuries. Much will come down to China, according to analysts at Goldman Sachs Group Inc. The nation accounts for 50% of global demand and the government can readily stoke its economy with spending on copper-intensive infrastructure. If the U.S. economy lags and the dollar weakens, buyers in China would have an additional advantage in importing commodities like copper that are priced in the American currency, analysts at the bank said in an emailed note. Even with the global case count rising rapidly, assets like copper and gold may yet rally further, the bank predicts.

Read the full article from Yahoo + |

|

|

Copper Labor Tensions Add to Steady Drumbeat of Copper Supply Threats

The steady stream of supply news fueling copper’s rally continued on Monday, with one Chilean mine reportedly cutting its workforce and another facing a strike. Lundin Mining Corp.’s Candelaria is reducing its headcount by 7% as the coronavirus pandemic spreads in the top copper-producing nation, according to unions. In the same region of northern Chile, supervisors at Antofagasta Plc’s Centinela mine rejected a final wage offer and voted to strike. The cutback and potential labor disruption add to concerns over Chile’s ability to maintain output as more workers fall ill, with copper prices surging to the highest in two years. Major mines in the country have shelved non-essential activities and demobilized workers to focus on output. “Supply threats can be a forceful temporary driver and on that basis momentum can take it higher,” Ole Hansen, head of commodity strategy at Saxo Bank A/S, said by email.

Read the full article from Bloomberg + |

|

|

Copper Can copper products protect you from COVID-19?

A spike in cases also means a surge in products promising anti-viral protection. Copper is one the materials in high demand. The company Aeris calls their copper phone case -- your newest tool in the fight against COVID-19.COO Andrew Medland says he and his college roommate came up with idea for a copper phone case while they quarantined. “Our research found there is a lot of information about copper killing all forms of germs, so we like to call it an anti-pathogenic.” Experts say there is some science behind coppers rise in popularity. “The coronavirus SARS-coV-2 persisted a lot less time on a pure copper surface compared to other surfaces like plastic or cardboard,” said University of Arizona microbiologist Michael Johnson. Johnson says while there has been research on copper, any specific product needs to be tested to verify claims. He says different alloys or coatings might not have the same effect, and something like a phone case still leaves a lot of unprotected area. Also, viruses can still last hours on copper. That is plenty of time for transmission.

Read the full article from KGUN9 + |

|

|

|

|

|

|

|

|

|

II. Updates of Themes on MRP's Radar Follow-up analysis of key market drivers monitored by MRP. |

|

|

|

|

|

|

|

|

|

|

IV. Active Thematic Ideas MRP's active long and short themes, with an archive of follow-up reports. |

See Them Here → |

|

|

|

|

V. Macroeconomic Indicators Key data releases relevant to MRP's Active Thematic Ideas. |

See Them Here → |

|

|

|

|

|

|

Select a theme to see when and why we added it. Also included is a link to all recent Market Insight reports we've written about that theme, allowing you to track its progress. |

|

|

|

|

|

|

|

|

US Industrial Output Rises More than Expected

Total industrial production in the United States rose 5.4 percent from a month earlier in June 2020 after increasing 1.4 percent in May, beating market expectations of a 4.3 percent growth. Manufacturing output climbed 7.2 percent, but it was still 11.1 percent below its pre-pandemic February level, as motor vehicles and parts jumped 105.0 percent, while factory production elsewhere rose 3.9 percent. In addition, utilities output grew 4.2 percent, as both gas and electric utilities posted gains, while mining output fell 2.9 percent, with declines in nearly all categories. For the second quarter as a whole, industrial output fell 42.6 percent at an annual rate, its largest quarterly decrease since the industrial sector retrenched after World War II.

Click here to access the data + |

|

|

|

|

US Capacity Utilization Beats Forecasts

Capacity utilization in the United States rose to 68.6 percent in June 2020 from 64.8 in the previous month and above market expectations of 67.7 percent. Still, capacity utilization is at a rate that is 11.2 percentage points below its long-run (1972–2019) average of 80.1 but 1.9 percentage points above its trough during the Great Recession, as many factories resumed operations following restrictions related to COVID-19.

Click here to access the data + |

|

|

|

|

China Quarterly GDP Growth Strongest on Record

The Chinese economy grew by a seasonally adjusted 11.5 percent on quarter in the three months to June 2020, following a revised 10.0 percent contraction in the previous quarter and compared with market expectations of a 9.6 percent increase. This was the strongest pace of quarterly expansion on record, boosted by improving demand at home and abroad following the easing of COVID-19 lockdown restrictions. The economy grew by 3.2 percent year-on-year in the second quarter of 2020, rebounding from a record 6.8 percent contraction in the previous three-month period and beating market consensus of a 2.5 percent expansion.

Click here to access the data + |

|

|

|

|

China Industrial Output Expands for 3rd Month

China's industrial production rose by 4.8 percent from a year earlier in June 2020, the largest increase in six months and slightly above market consensus of 4.7 percent, as the economy gradually emerged from COVID-19 pandemic and more factories reopened their activity. Among major industries, production grew for electrical machinery (8.7 percent), metal products (2.6 percent), general equipment manufacturing (7.4 percent), automotive (13.4 percent), computer, communications and other electronic equipment (12.6 percent) pharmaceuticals (3.9 percent), ferrous metal smelting (6.3 percent), non-metallic mineral products (4.8 percent), chemical raw materials (4 percent) and power equipment (6.3 percent). For the first six months of 2020, industrial production fell by 1.3 percent.

Click here to access the data + |

|

|

|

|

India Posts Largest Trade Surplus on Record

India posted a USD 0.79 billion trade surplus in June 2020, the largest on record and first since 2002, compared with market expectations of a USD 4.50 billion deficit, as imports tumbled much more than exports amid subdued demand due to the coronavirus crisis. Imports was down 47.59 percent with the biggest decreases reported for: gold (-77.42 percent), coal, coke & briquettes (-55.72 percent), petroleum, crude & products (-55.29 percent), machinery, electrical & non-electrical (-42.02 percent) and electronic goods (-34.05 percent). Meanwhile, exports fell at a slower 12.41 percent led by lower sales of gems & jewelry (-50.06 percent), leather & leather products (-40.47 percent), RMG of all textiles (-34.84 percent), man-made yarn, fabrics (-31.98 percent) and petroleum products (-31.65 percent). Considering the April to June period, the trade deficit narrowed sharply to USD 9.12 billion from USD 45.96 billion in the same period of the previous fiscal year.

Click here to access the data + |

|

|

|

|

Oil Prices Fall after OPEC+ Confirms Taper

Oil prices dropped on Thursday, with WTI futures around $40.6 a barrel and Brent crude near $43.4 a barrel after OPEC+ agreed that major oil producers' output cuts would be eased to 7.7 million bpd from August until December, compared to July's record 9.7 million bpd cuts. The tapering will be partially offset by reduced production from some countries that did not meet their targets. Putting a floor under prices was data from both EIA and API which showed a drop in US crude inventories last week. The EIA reported the largest fall in US crude stockpiles in over six months and the API showed US crude inventories tumbled by the most since August 2019.

Click here to access the data + |

|

|

|

|

MARKET INSIGHT UPDATES: SUMMARIES |

|

|

Manufacturing & Logistics |

|

|

Robotics & Automation Robots, automation seen as solutions to social distancing hurdles in supply chain

Fifty-one percent of employees at companies that directly manage warehouses, distribution centers or fulfillment centers say the coronavirus pandemic has made their company more willing to invest in automation, according to a survey from Honeywell and KRC Research conducted between April 21 and May 7. More than any other industry, respondents that worked in e-commerce suggest their companies are more willing to invest automation as a result of the pandemic (66%) and it was the industry most likely to report automation as having been helpful during the pandemic thus far (54%). Gap is one of the companies that has changed its robotics strategy as a result of the pandemic. Last month, Kindred AI announced the retailer had purchased 73 of its SORT robots to install in its U.S. distribution centers, which would bring its total fleet to 106. Gap plans to complete the installation this month, according to Reuters. The brand saw a 40% increase in customers migrating from retail only to multi-channel in the first quarter of 2020 compared to the same time last year, according to the company's earnings. The SORT systems already in place have helped to sort more than 13 million units of merchandise between Jan. 1 and April 30, Kindred said in a release. (Related ETF: ROBO)

Read the full article from SupplyChainDive + |

|

|

|

|

|

|

5G Phillips 66 Eyes 5G at Louisiana Refinery

Accenture and AT&T are teaming up with Phillips 66 to develop a private cellular network near the latter company’s refinery in Belle Chasse, La. The private network’s industrial cellular wireless connectivity – designed to overcome performance gaps with the existing public cellular network near the New Orleans-area refinery – will facilitate deploying the Industrial Internet of Things (IIoT) and other potential 5G-reliant installations, Accenture noted in a written statement last week. Accenture also confirmed to Rigzone that such a potential 5G cellular system would be unprecedented in the U.S. refining industry and could open new refinery automation opportunities. According to Accenture, the private cellular network comprises a local cellular network that includes cell sites and core network servers that support the connectivity of a specific organization’s requirements. The firm added the private network was selected as a proof of concept to demonstrate the ability to handle increased mobile connectivity needs from ongoing Phillips 66 digital transformation efforts. It also stated that AT&T was chosen as the telecommunications provider to develop the necessary engineering for a dedicated cellular network.

(Related ETF: FIVG, NXTG)

Read the full article from Rigzone + |

|

|

|

|

|

|

Agricultural Commodities Floods and the coronavirus create more uncertainty for China as food prices climb

Food prices in China rose 11.1% in June from a year ago, according to the National Bureau of Statistics. Weekly data showed prices of agricultural food products rose 1.2% in the week ended July 5 from a week ago and another 0.8% in the week through Sunday. Authorities have been closely monitoring food prices as they are an important aspect of maintaining social stability. Severe floods, which some have described as the worst since at least 1998, have left at least 141 people dead or missing. Direct economic losses have surpassed 86 billion yuan ($12.3 billion). Analysts from Hangzhou-based Nanhua Futures, a brokerage, said in a note last week that the impact on food prices will only be in the short term, while the floods will have a greater effect on live pork production.

Prices for pork have more than doubled over the last 18 months as African swine fever caused a shortage of the Chinese meat staple. Pork prices remained elevated in June, up 81.6% from a year ago. The prices remained high despite increased Chinese purchases of foreign food products. In the first half of the year, China’s imports of pork rose 140% from a year ago, while that of beef rose 42.9% and soybeans increased 17.9%, according to Customs Administration data released Tuesday.

(DBA, COW, HOGS.L)

Read the full article from CNBC + |

|

|

|

|

|

|

Energy Fossil Fuel Companies Are Losing Value Globally

The Australia Institute recently published a paper detailing how fossil fuels are the worst-performing sector on the ASX 300 and have been for the past decade. $100 invested in the S&P ASX 300 Energy Index back in 2010 was only worth $104 by January 2020. It dropped to $51 with COVID-19. Fossil fuel companies lost twice as much value when compared to the broader market over the first quarter of 2020. One of the main factors that contributed to that drop was COVID-19, along with surging oil supply from the oil price war between Russia and Saudi Arabia. While COVID-19 exacerbated the underperformance of fossil fuel stocks, this is actually a long-term issue. Not only did the ASX 300 Energy Index underperform, but it was also the worst-performing of all sectors on the ASX. It was the only sector to record zero growth over the decade, and the only sector to have lost value over the decade — even after the crash. The paper noted that an investment of $100,000 in the ASX 300 over the last decade would have been worth $237,000 at the peak in February 2020, falling by 31 March to $169,000.

The paper shared that these trends in Australia are reflected throughout the world.

(Related ETF: XLE)

Read the full article from CleanTechnica + |

|

|

|

|

Biotechnology & Healthcare |

|

|

COVID Vaccine First Coronavirus Vaccine Tested in Humans Shows Early Promise

An experimental coronavirus vaccine made by the biotech company Moderna provoked a promising immune response against the virus and appeared safe in the first 45 people who received it, researchers reported on Tuesday in The New England Journal of Medicine. Moderna’s vaccine, developed with researchers at the National Institute of Allergy and Infectious Diseases, was the first coronavirus vaccine to be tested in humans, and the company announced on Tuesday that large Phase 3 tests of it would begin on July 27, involving 30,000 people. Half of the participants will be a control group who will receive placebos. The trial will need to show that those who were vaccinated were significantly less likely to contract the virus than those who got a placebo. The fastest way to get results is to test the vaccine in a “hot spot” with many cases, and the study is looking for people at high risk because of their locations or circumstances. Experts agree that more than one vaccine will be needed, because no single company could produce the billions of doses needed.

(Related Stock: MRNA)

Read the full article from The New York Times + |

|

|

|

|

|

|

|

|

|

|

|

ABOUT THE DIBS AND MCALINDEN RESEARCH PARTNERS

McAlinden Research Partners (MRP) publishes daily and other periodic reports on the economy and the markets.

MRP focuses on identifying change in the global economy and offering an investment thesis whenever an opportunity arises that has not yet been recognized by the market. The DIBs are MRP's compilation of articles and data from multiple sources on subjects reflecting change that have potential investment implications for an industry or group of securities. We share these with our clients who may already have or may be considering exposure in the industries affected. The subjects change daily and constitute an excellent update on featured topics. |

|

|

The information provided in this Report is not to be reproduced or distributed to any other persons. This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication. |

|

|

|

|

|

|